Key benefits and highlights

CB Rewards

Earn CB Rewards on spends:

- You will earn one point for every QAR 20 spent using your Sadara Credit Card.

- You will earn one point for every QAR 15 spent on Diners Club Credit Card.

- No Cap on CB Rewards earning.

- You are eligible for 10,000 CB Reward Points worth of QAR 1000.

- Terms & Conditions apply .

Local Merchant Offers and Discounts

- Exclusive offers and deals on travel, lifestyle, shopping and more. For more information, please click here.

- BNPL plans at select Merchant Outlets.

- Buy 1 get 1 offer on tickets at Novo Cinemas.

Travel Benefits:

- YQ meet & assist

- Access to 1000+ airport lounges in more than 300 cities all around the world

- Concierge service

- Agoda.com discount offer

- IHG Hotels & Resorts

- Visa Luxury Hotel Collection

- Avis Car Rental

- And much more

Protection:

- Multi-trip travel insurance

- Medical & travel assistance

- Global Customer Assistance Services

- Extended Warranty

Lifestyle Benefits:

- Bicester Village Shopping Collection

- FARFETCH

- The ENTERTAINER

- Booking.com instant reward

- Visa Golf Access

- NOVO cinema Buy One Get One

Joining Bonus Reward Points

You are eligible for 10,000 CB Reward Points worth of QAR 1000 if your retail spend reaches (excluding Buy Now Pay Later, Cash Advance transactions & any fees/charges) QAR 15,000 within 90 days of card activation.

The joining bonus reward points have a validity period of 90 days from the date of credit.

Commercial Bank joining bonus reward points are given only once (i.e., if you cancel your card and reapply, you will not be eligible for joining reward bonus points).

CB Reward Points

You will earn one point for every QAR 15 spent on Diners Card and QAR 20 spent on Mastercard on retail purchase transactions excluding transactions done with the categories below:

- Dynamic Currency Conversion (DCC).

- All Government Merchant Category Codes (MCC).

- All Charity related Merchant Category Codes (MCC).

- All Insurance related Merchant Category Codes (MCC).

- All European Union Card present transactions.

- Transactions made locally in Qatar (with Qatar currency) through merchants listed outside of Qatar will not qualify for reward point earnings.

*Terms and conditions apply.

CB Reward Points have a validity of 24 months from the date of credit.

CB Reward Points can be easily redeemed for instant Avios, flights & hotels stays, Rent-a-Car, and many other shopping vouchers. For more information please visit cbqrewards.com.

Complimentary Lounge Access

With Visa Airport Companion App, you will be able to register your Sadara Infinite Credit Card to access airport lounge privileges linked to your card. You can also view all accessible lounge locations, check your remaining yearly access, and determine further eligibility or additional access:

All you have to do is:

- 1. Download the Visa Airport Companion App starting today.

- 2. Register your Sadara Infinite Credit Card ahead of the trip.

- 3. Enjoy access to 1,200+ lounges worldwide.

For the list of airport lounges please click here.

Annual Fee:

- Card Fee is QAR 850 (free for Premium members).

Eligibility:

- Age between 18 to 65 for Qataris.

- Age between 18 to 60 for Expats.

- A minimum monthly salary transfer of QAR 35,000 or Total loans/deposits of QAR 350,000.

Frequently Asked Questions

If your card is lost or stolen, you should immediately block the card permanently and order a replacement. You can block and replace your card in multiple convenient ways.

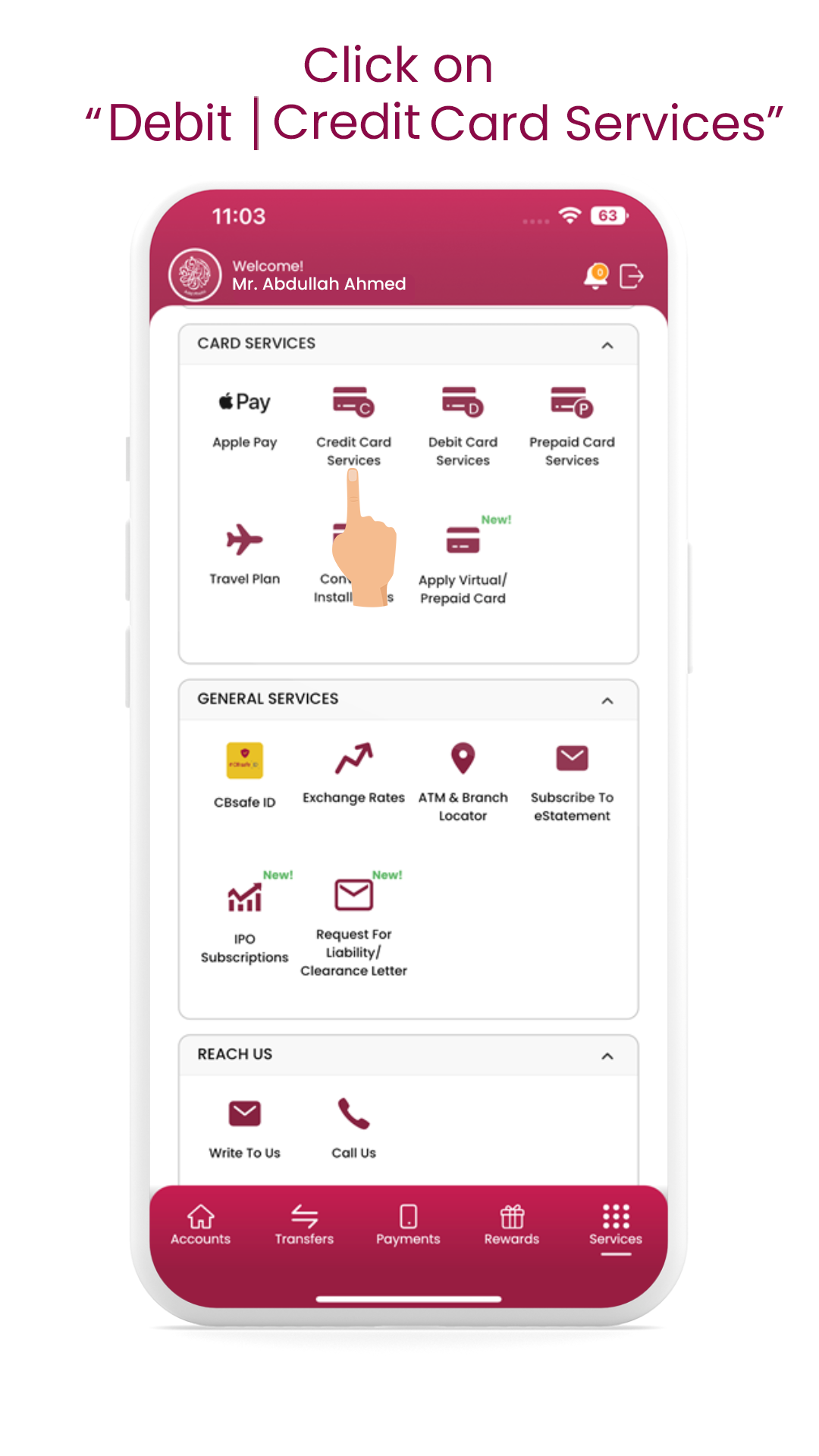

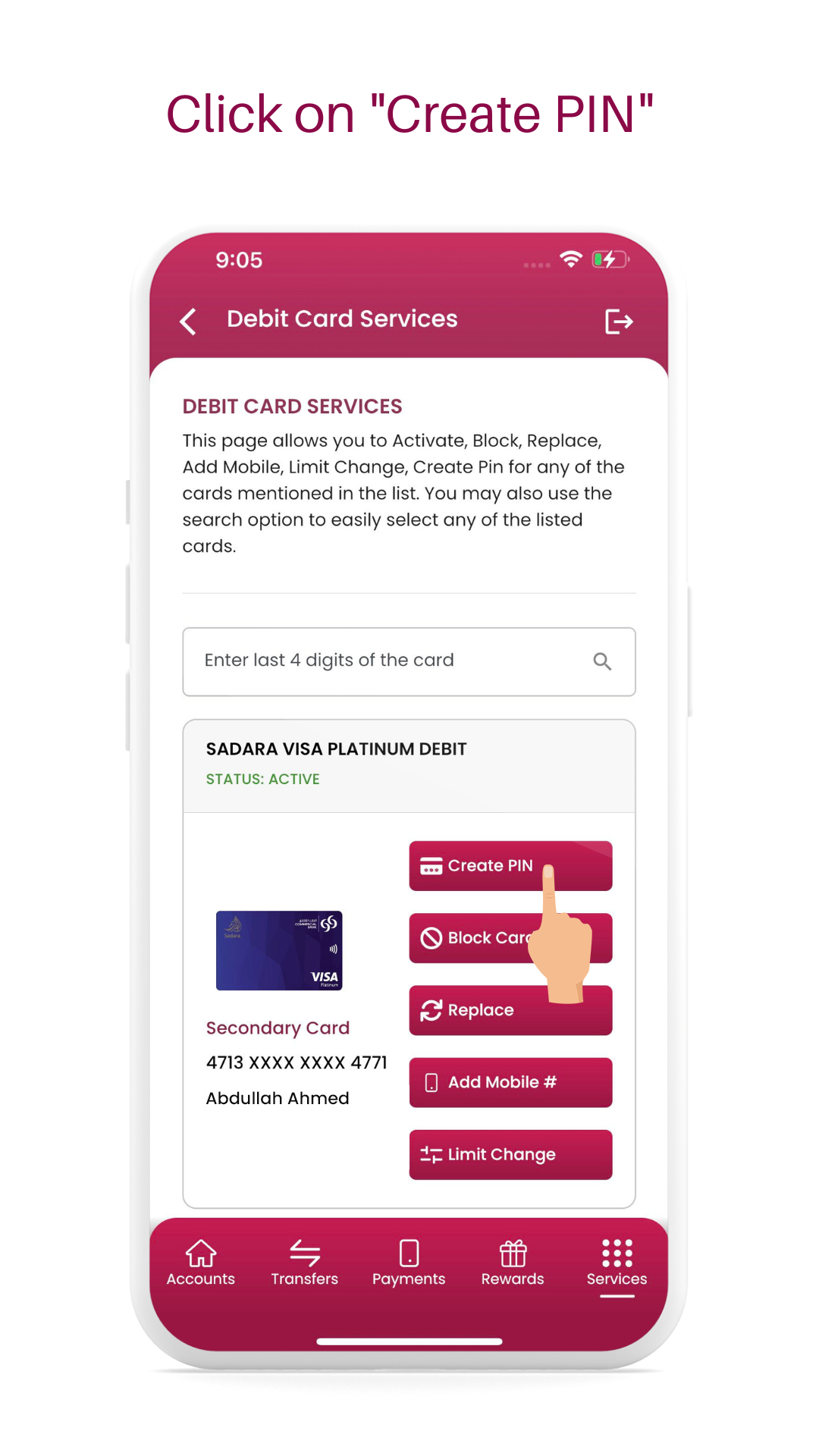

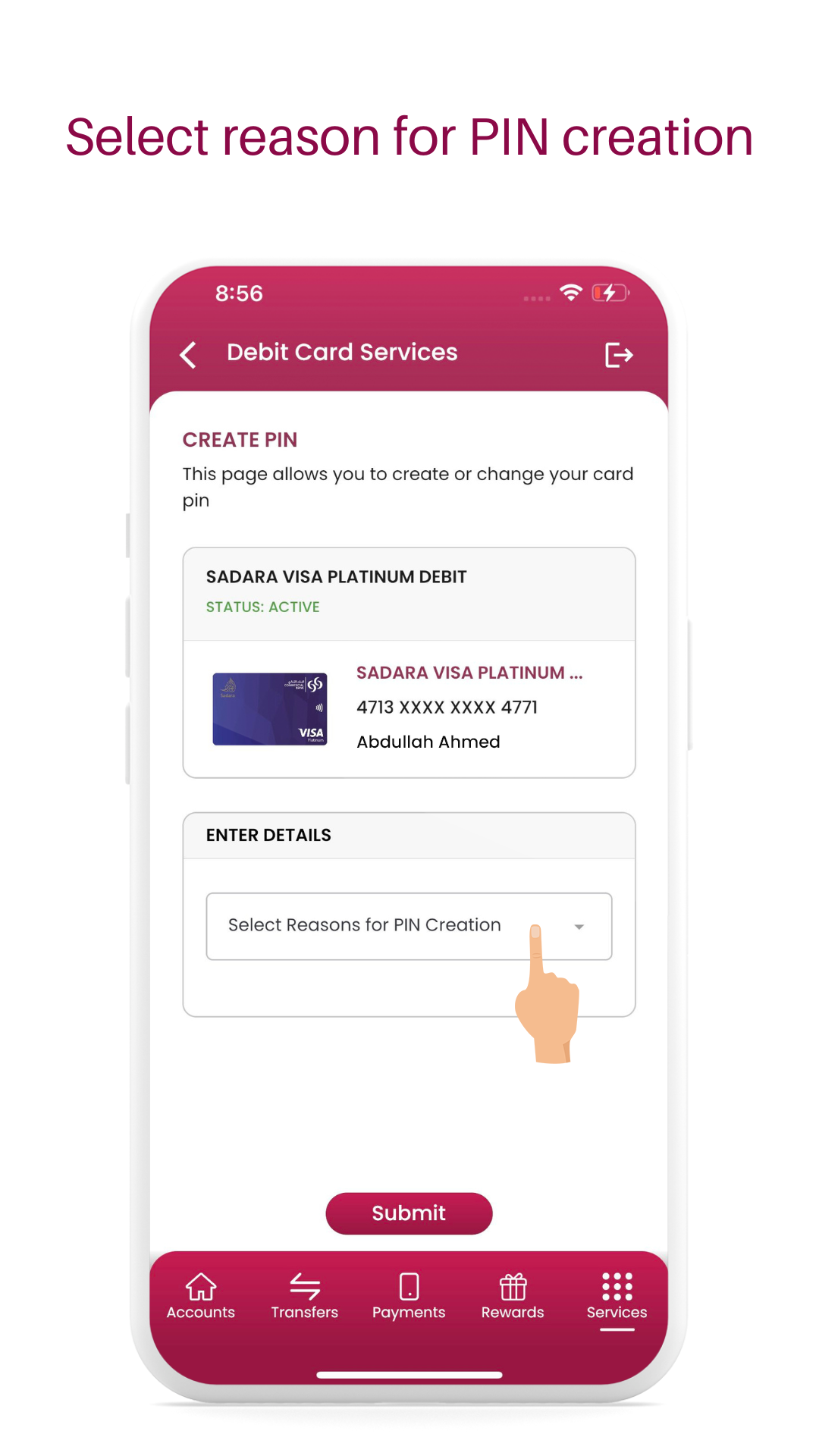

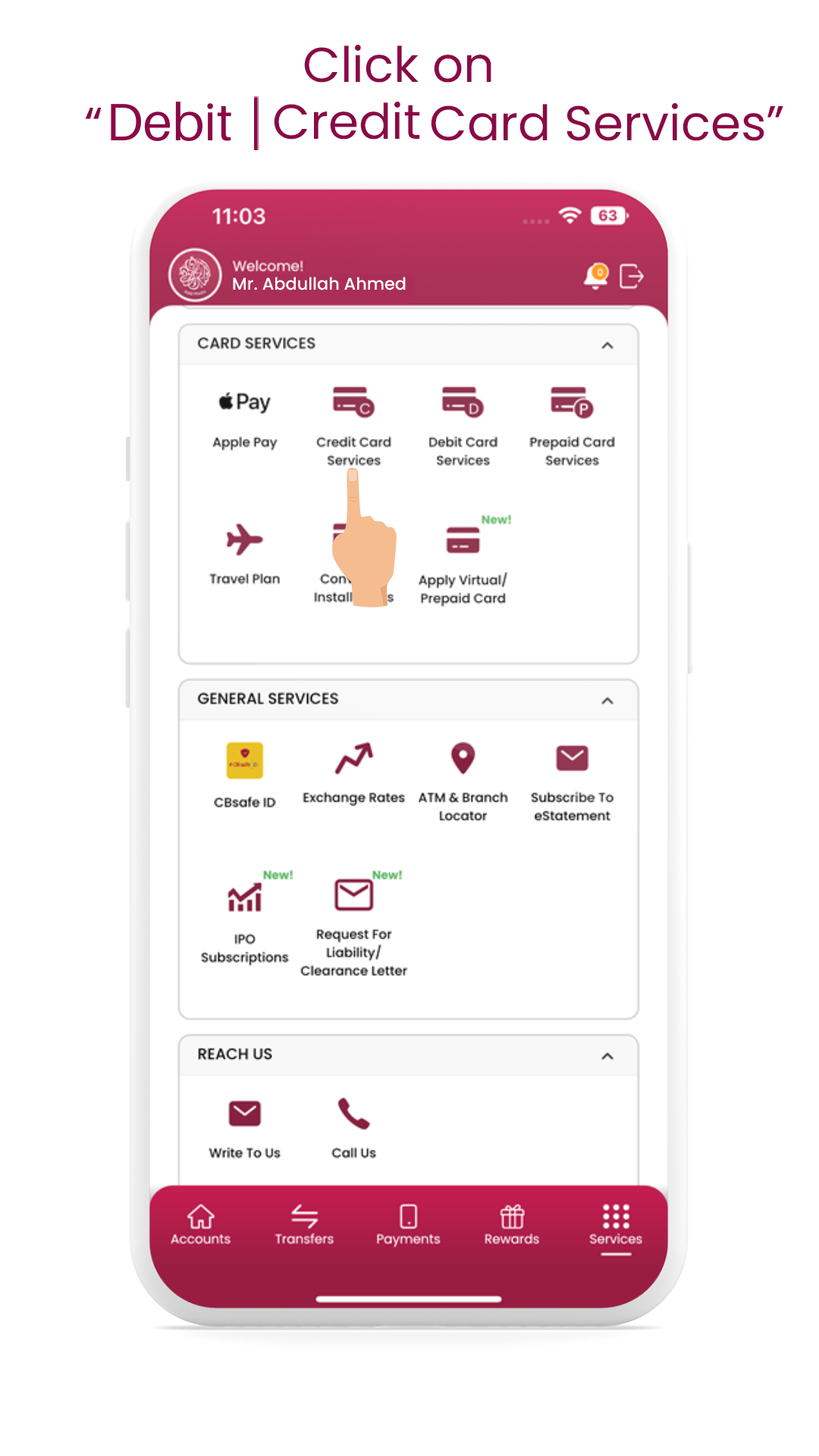

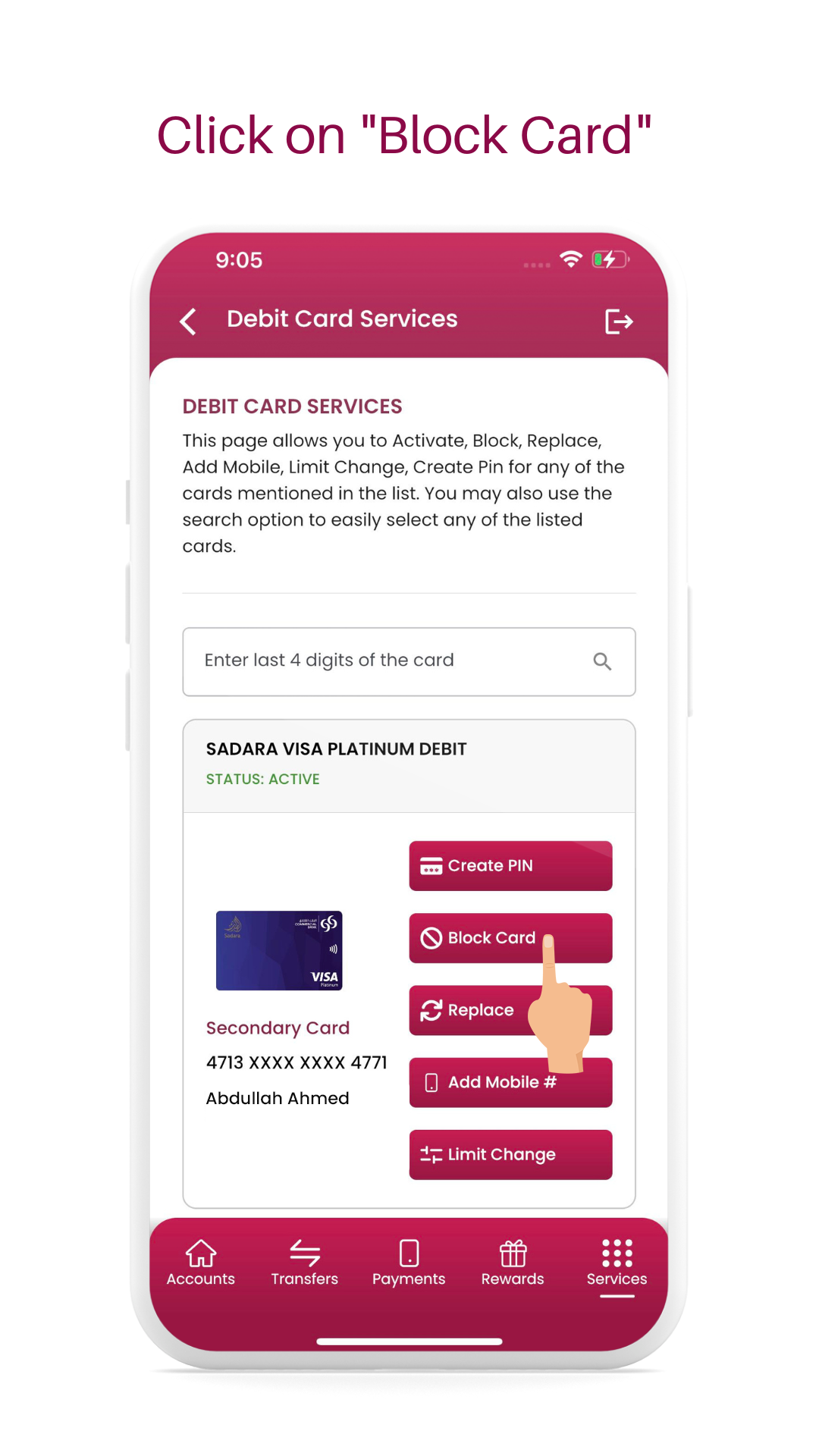

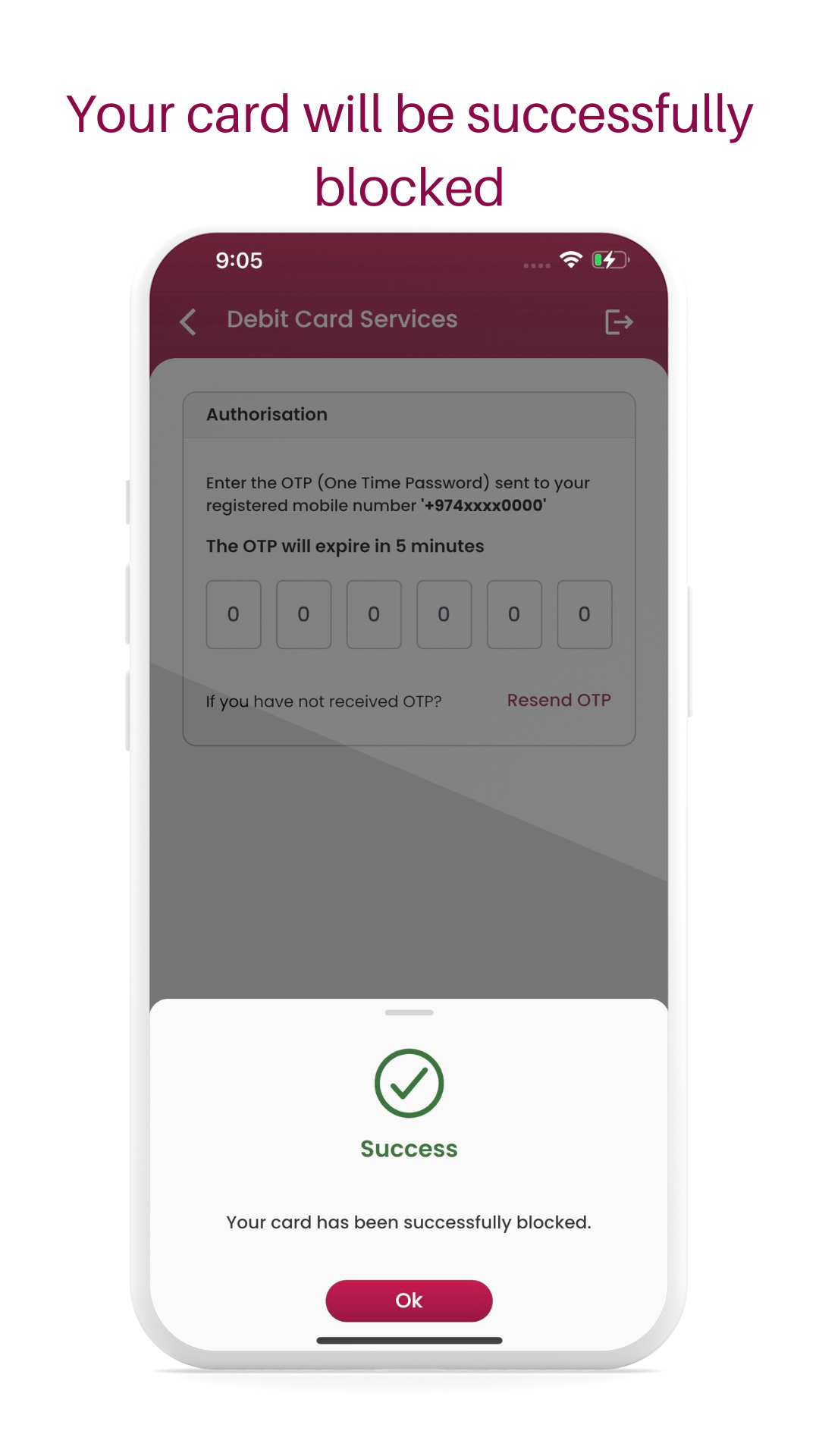

CBQ Mobile App or Internet Banking

- Login to CBQ Mobile App or Internet Banking.

- Select the “Services” tab.

- Under menu, click on the “Debit Card Services” or “Credit Card Services”.

- Choose the appropriate card to be blocked.

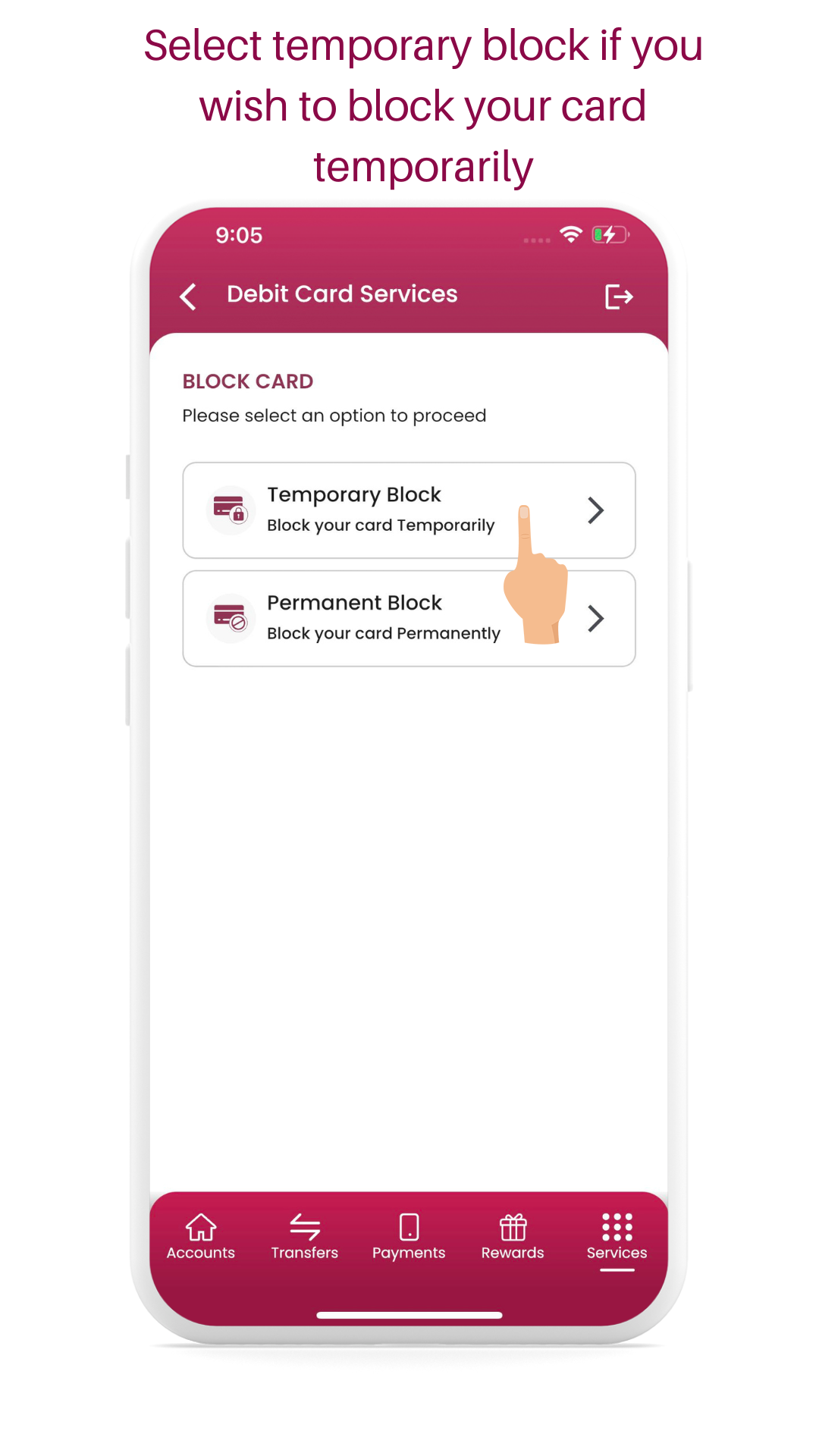

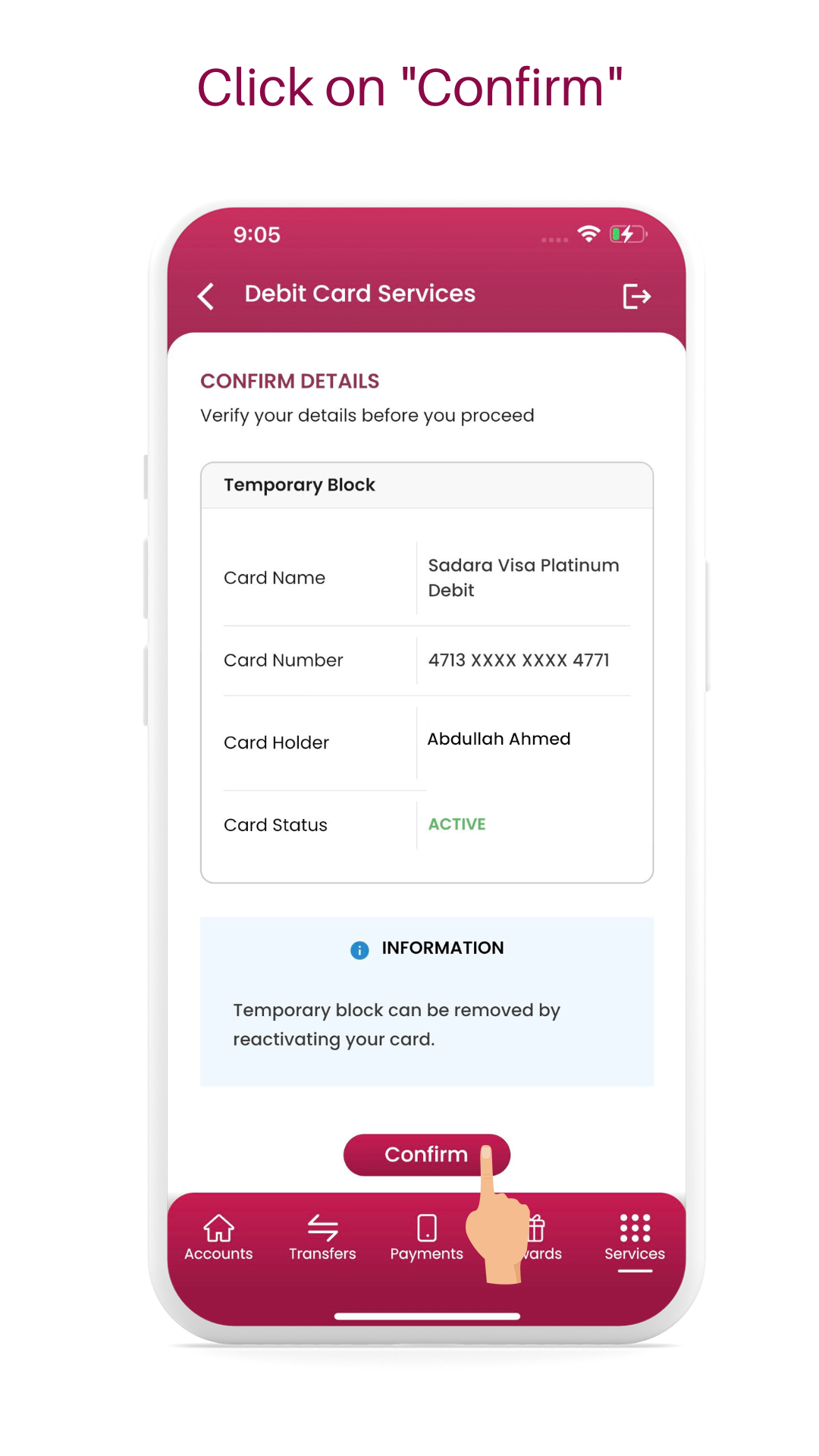

- Select the “Block Card” option and select the option “Permanent” to block your card permanently.

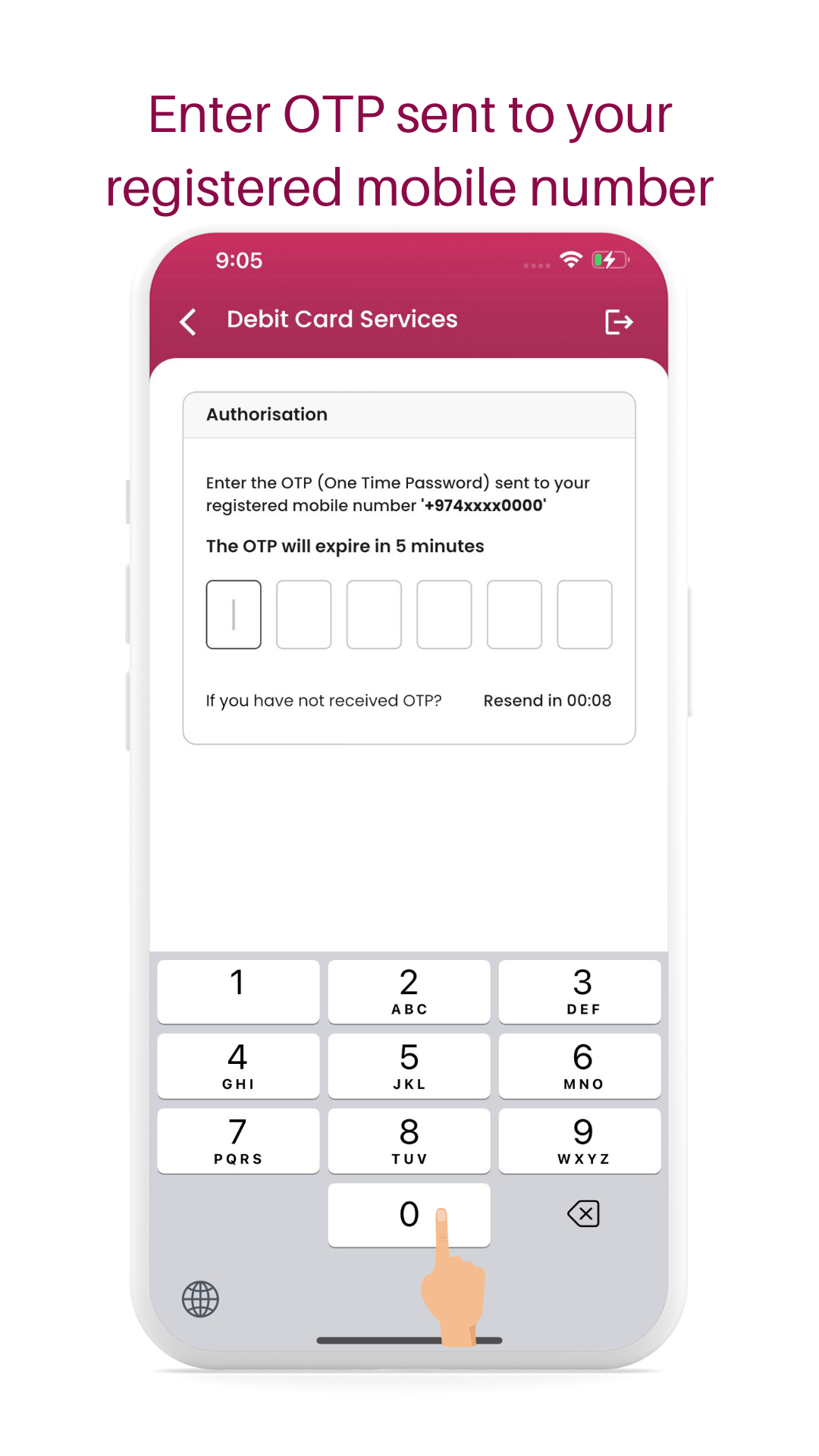

- Enter the OTP sent to your registered mobile number to block your card.

- Your card will be blocked successfully.

To replace the card, follow the below steps:

- Login to CBQ Mobile App or Internet Banking.

- Select the “Services” tab.

- Under menu, click on the “Debit Card Services” or “Credit Card Services”.

- Click on “Replace”

- Enter the OTP sent to your registered mobile number to replace your card.

- Your card will be replaced successfully. You will receive notification on how to print the card latest within next working day.

Contact Centre:

- Call our dedicated fraud reporting hotline number at 44495095

- Select your preferred language (English/Arabic)

- Listen to the IVR prompt and select "option 2" to block your card.

- IVR will allow you to temporary block a selected card or your entire cards instantly.

Call will be connected to an agent who can assist with replacing your cards.

If your Commercial Bank card is captured in any CB ATM, please follow the steps below to retrieve it:

- You will receive an SMS notification with details of the CB location where your captured card will be available for collection within 2–3 working days.

- Once you receive the notification, you may book an appointment to visit this CB location and collect your card (click to Book Appointment)

Alternatively, you may proceed to block the captured card and request for a replacement via our digital channels

Note: If your Commercial Bank card is captured in a non-CB ATM within Qatar or overseas, we recommend blocking your card immediately and requesting for a replacement.

Ways to activate your card

Additional Benefits & Features

Contactless Payments

/cbpay.png?h=99&iar=0&w=100&hash=5E31B8B0AB6824CDCAC72E77AA85A9C1)

/applepay.png?h=99&iar=0&w=100&hash=A7CC4F23EC0EBAC8E4DD6A0555F878F8)

/gpay.png?h=99&iar=0&w=100&hash=43CA7686609401E901542773D704DAAE)

/fitbitpay.png?h=99&iar=0&w=120&hash=C4BE28B649D0413C0CA6E83F865FED5D)

/garminpay.png?h=99&iar=0&w=120&hash=A712BEC339763E6ABDC4DF714E87842A)

/checklist/authenticity.png?h=512&iar=0&w=512&hash=26F936525A7AE145085017B6C7576AFC)

/checklist/discount.png?h=512&iar=0&w=512&hash=08482E2BBD77FA46F1EC81725F8A1435)

/checklist.png?h=54&iar=0&w=50&hash=9C4EF8220DB8DF1FB613B11A257E6D41)