Commercial Bank launches direct payment service in cooperation with General Tax Authority

16 November 2021

Doha, Qatar: November 16, 2021: Commercial Bank, the leading digital bank in Qatar, launched in cooperation with General Tax Authority a direct payment service from the taxpayer’s account to the authority’s account to facilitate the procedures for paying tax obligations for the bank’s customers.

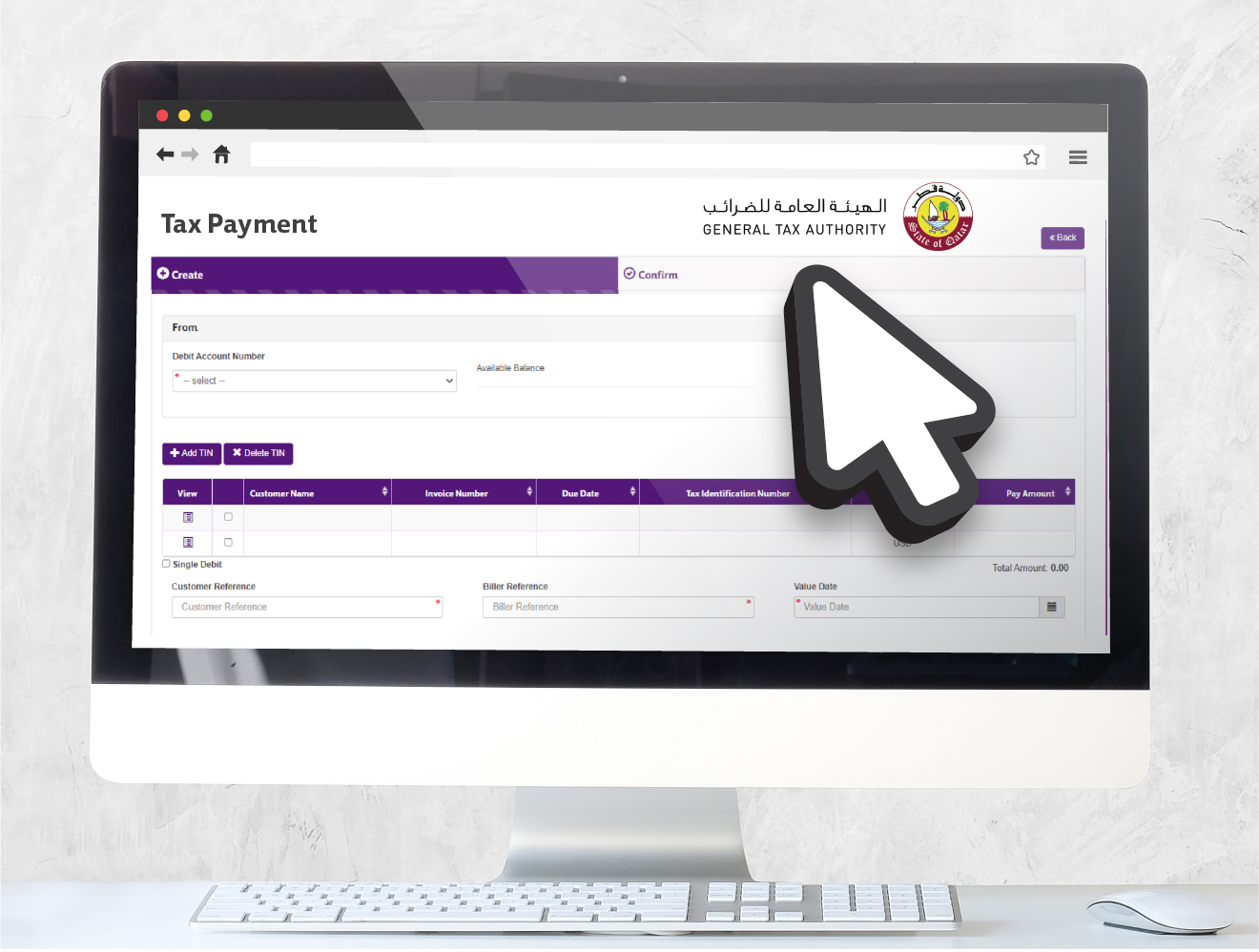

This solution benefits all Commercial Bank customers in their tax payments as they can enquire current tax outstanding and make payment online in a secure way through Corporate Internet Banking (CIB) platform of the Bank.

Commercial Bank is always keen to launch payment initiatives that provide the best services to customers which include simple, fast and convenient payment initiation and processing. The latest innovation is CIB (CB online portal for corporates) integration with the General Tax Authority to provide seamless online payments of tax invoices.

Currently, Corporate Customers settle tax invoices by initiating funds transfer to GTA's account. This process does not support TIN or tax invoice validation and gives room for reconciliation challenges.

On this occasion, Raju Buddhiraju, EGM, Head of Wholesale Banking said: “This service comes in alignment with Commercial Bank’s strategy to provide customers with the most innovative digital banking solutions that provides them with fast and seamless payment solutions and therefore enhances their exclusive banking experience”.

GTA recently signed agreement with Commercial Bank to allow integration with their systems. Commercial Bank, in coordination with GTA, has completed the seamless integration to allow CB customers on CIB to enquire about their GTA tax invoices and make the required payments online. CIB will also provide real time update to GTA of the payment status. All payments made on CIB via this service will be auto reconciled at GTA. The service is available to all Public and Private sector Corporate and Enterprise customers of the bank.

Ends.