The Commercial Bank (P.S.Q.C.) Announces Net Profit of QAR 1,571.0 million for the half year ended 30 June 2024

16 July 2024

16 July 2024, Doha, Qatar: The Commercial Bank (P.S.Q.C.) (“the Bank"), its subsidiaries and associates (“Group") announced today its financial results for the half year ended 30 June 2024. The Group reported a net profit of QAR 1,571.0 million as compared to last year's reported net profit of QAR 1,554.3 million for H1 2023 which was restated to QAR 1,352.5 million for the same period in 2023, representing a 1.1% increase on a reported basis and a 16.2% increase on a restated basis.

The H1 2023 numbers were restated due to the restatement of the year-end 2023 financial statements for the underlying derivative on the share option performance scheme. Accordingly, the current H1 2024 figures provided are compared with the previous year restated numbers.

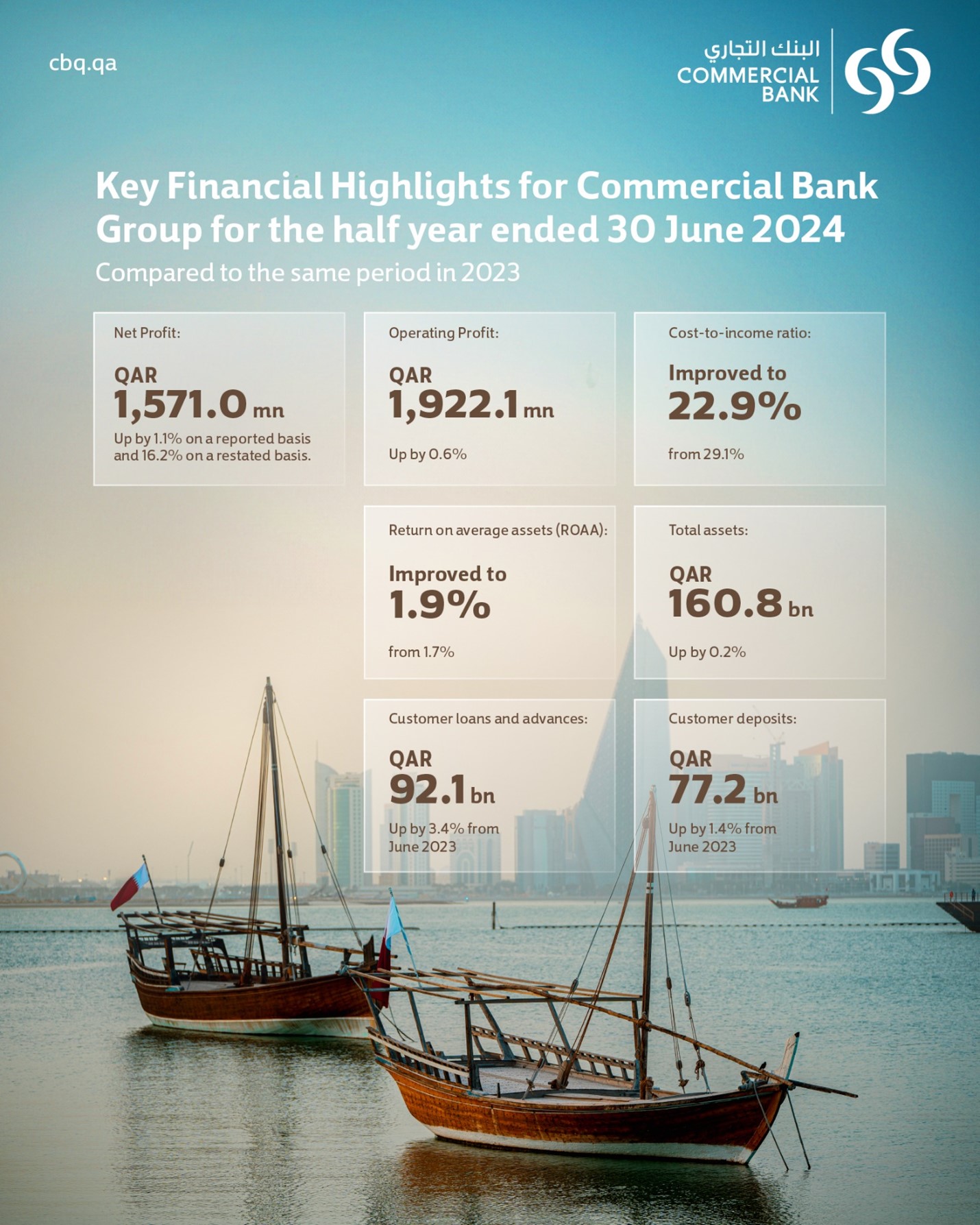

Key financial highlights for the Group compared to the same period in 2023

- Net profit of QAR 1,571.0 million, up by 1.1% on a reported basis and up by 16.2% on a restated basis.

- Operating profit of QAR 1,922.1 million, up by 0.6%.

- Cost-to-income ratio improved to 22.9% from 29.1%.

- Strong capital adequacy ratio at 17.2%.

- Return on average assets (ROAA) has improved to 1.9% from 1.7%.

- Total assets of QAR 160.8 billion, up by 0.2%.

- Customer loans and advances of QAR 92.1 billion, up by 3.4% from June 2023.

- Customer deposits of QAR 77.2 billion, up by 1.4% from June 2023.

- Fitch affirms Commercial Bank’s rating at “A” with a stable outlook.

- Moody's affirms Commercial Bank’s credit rating at “A2/Prime-1” with a stable outlook.

- “Best Mobile Banking App” award and “Best Remittance Service” award in the Middle East by MEED.

Sheikh Abdulla bin Ali bin Jabor Al Thani, Chairman of the Board of Directors of Commercial Bank, said, "

In the first half of 2024, Commercial Bank demonstrated strong performance despite the global banking sector's challenges. Forbes once again recognized us among the “Middle East's 30 Most Valuable Banks 2024." Additionally, Fitch affirmed our rating at 'A' with a stable outlook.

Our unwavering commitment to technology and innovation has enabled us to provide exceptional services that enhance the customer experience. During this period, we received the “Best Mobile Banking App" and the “Best Remittance Service" awards from the MEED – MENA Banking Awards 2024, reflecting our dedication to outstanding customer service.

Mr. Hussain Alfardan, Commercial Bank's Vice Chairman, said,

"We are pleased to report Commercial Bank's performance in the first half of 2024, reflecting the strength of the Qatari economy and our steadfast commitment to operational excellence.

We are dedicated to maintaining Commercial Bank's position as a leading banking provider in the region, continuing to contribute to the ongoing growth and prosperity of Qatar's economy, and supporting our customers and stakeholders in achieving their financial goals."

Operating profit for the Group was QAR 1,922.1 million for the six months ended 30 June 2024 compared with QAR 1,911.0 million achieved in the same period in 2023.

Net interest income for the Group was QAR 1,866.7 million for the six months ended 30 June 2024 compared with QAR 1,935.0 million achieved in the same period in 2023, due to higher cost of funds.

Non-interest income for the Group was QAR 626.0 million for the six months ended 30 June 2024 compared with QAR 760.3 million achieved in the same period in 2023, due to reduced FX and trading income.

Total operating expenses were QAR 570.6 million for the six months ended 30 June 2024 compared with QAR 784.3 million in the same period in 2023 mainly due to decreased staff related LTIP (long term incentive program) costs under IFRS 2.

The Group's net provisions fell to QAR 426.9 million for the six months ended 30 June 2024, from QAR 575.5 million in the same period in 2023, due to higher recoveries and ECL release. Non-performing loan (NPL) ratio stood at 5.9% at 30 June 2024 compared to 5.5% at 30 June 2023.

The Group's

balance sheet as at 30 June 2024 is at QAR 160.8 billion.

The Group's

loans and advances to customers has increased by 3.4% to QAR 92.1 billion at 30 June 2024 as compared to QAR 89.0 billion in June 2023, mainly due to increased government & public sector borrowings and retail lending.

The Group's customer deposits has increased by 1.4% during the year to QAR 77.2 billion at 30 June 2024, compared with QAR 76.1 billion in the same period in 2023.

Mr. Joseph Abraham, Commercial Bank's Group Chief Executive Officer, commented,

“Throughout the first half of 2024, Commercial Bank continued to execute on our five-year strategic plan, we continue to focus on shaping our business as a leader in client experience and digital innovation, resulting in positive financial performance for the period ending 30 June 2024. As loan growth continued to show positive momentum reflecting the strong pipeline, Capital also continued to improve to 17.2% in line with our guidance and we will continue to focus efforts in the second half of the year to continue this positive momentum.

The Group witnessed an improvement in its cost-to-income ratio, reaching 22.9%, compared to 29.1% in the first half of 2023. This reduction in expenses was largely attributed to decreased staff related LTIP compensation costs, a consequence of IFRS 2 due to the decline in share price.

Our associates have demonstrated a strong performance, which grew by 8.9% increase in share of associates, reaching QAR 158.2 million compared to QAR 145.3 million in the same period of 2023.