Frequently Asked Questions

Your card can be activated using our digital channels.

If your card is still waiting to complete the Pending Documentation/Salary credit requirements, please compete the documentation requirement before proceeding to our digital channels to activate the cards.

Commercial Bank offers multiple ways for activating your card from anywhere, at any time: you can activate your Debit card by logging in to your mobile app or internet banking channel, by SMS, or by contacting the call center at 4449 0000.

You can issue a supplementary card to your immediate family members. To issue a card a Supplementary card application and the QID of the supplementary cardholder should be submitted to a branch.

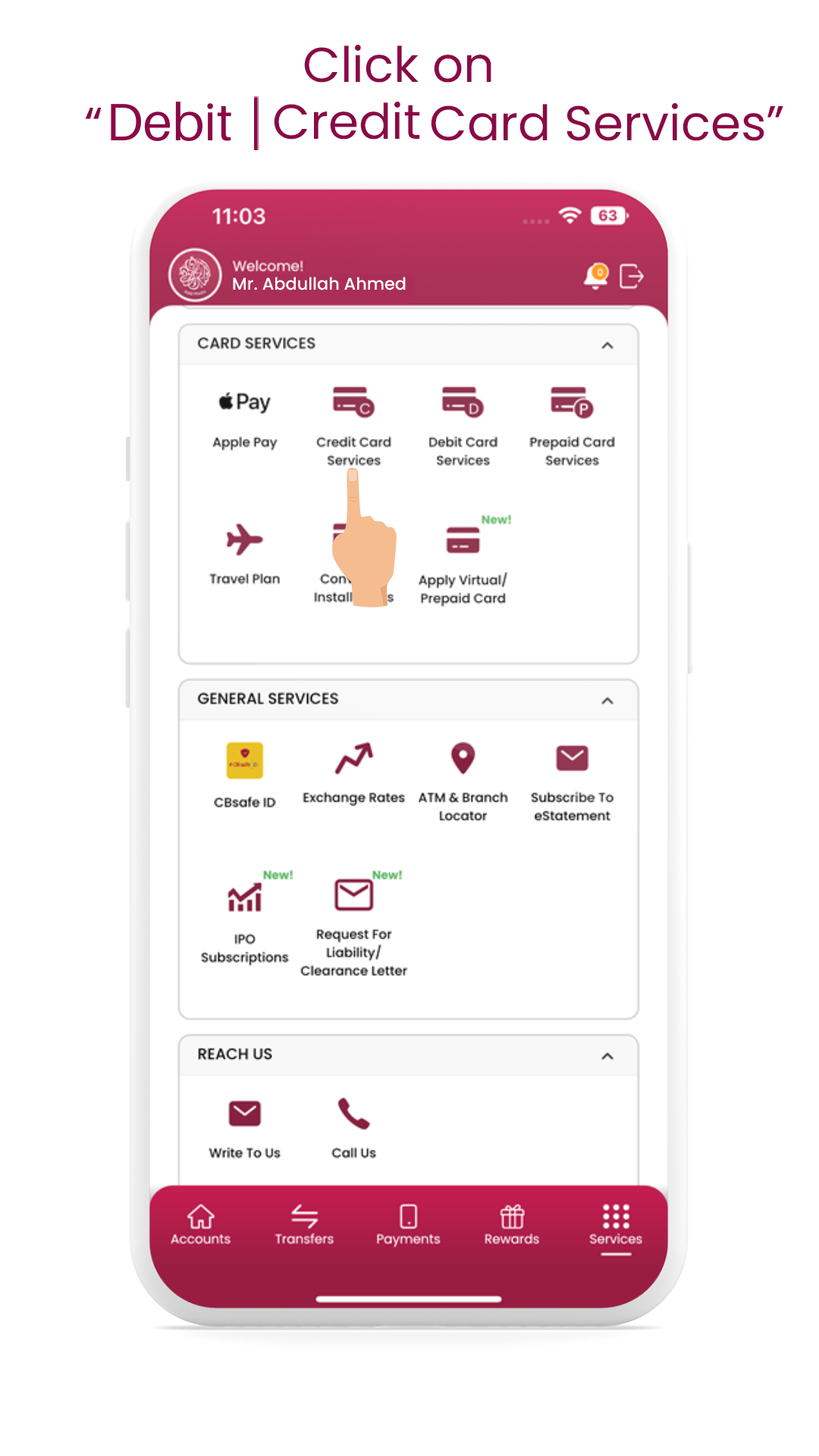

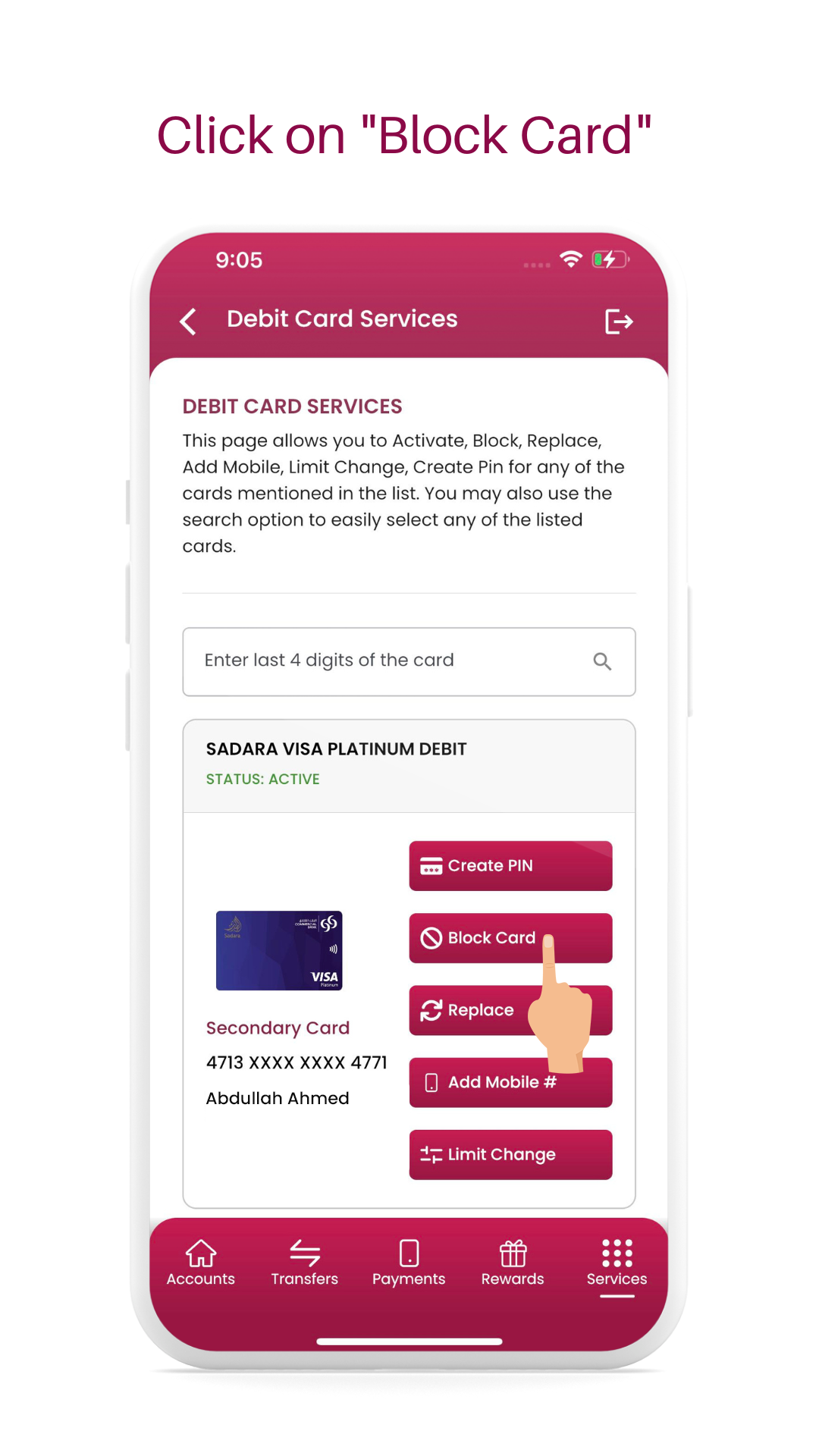

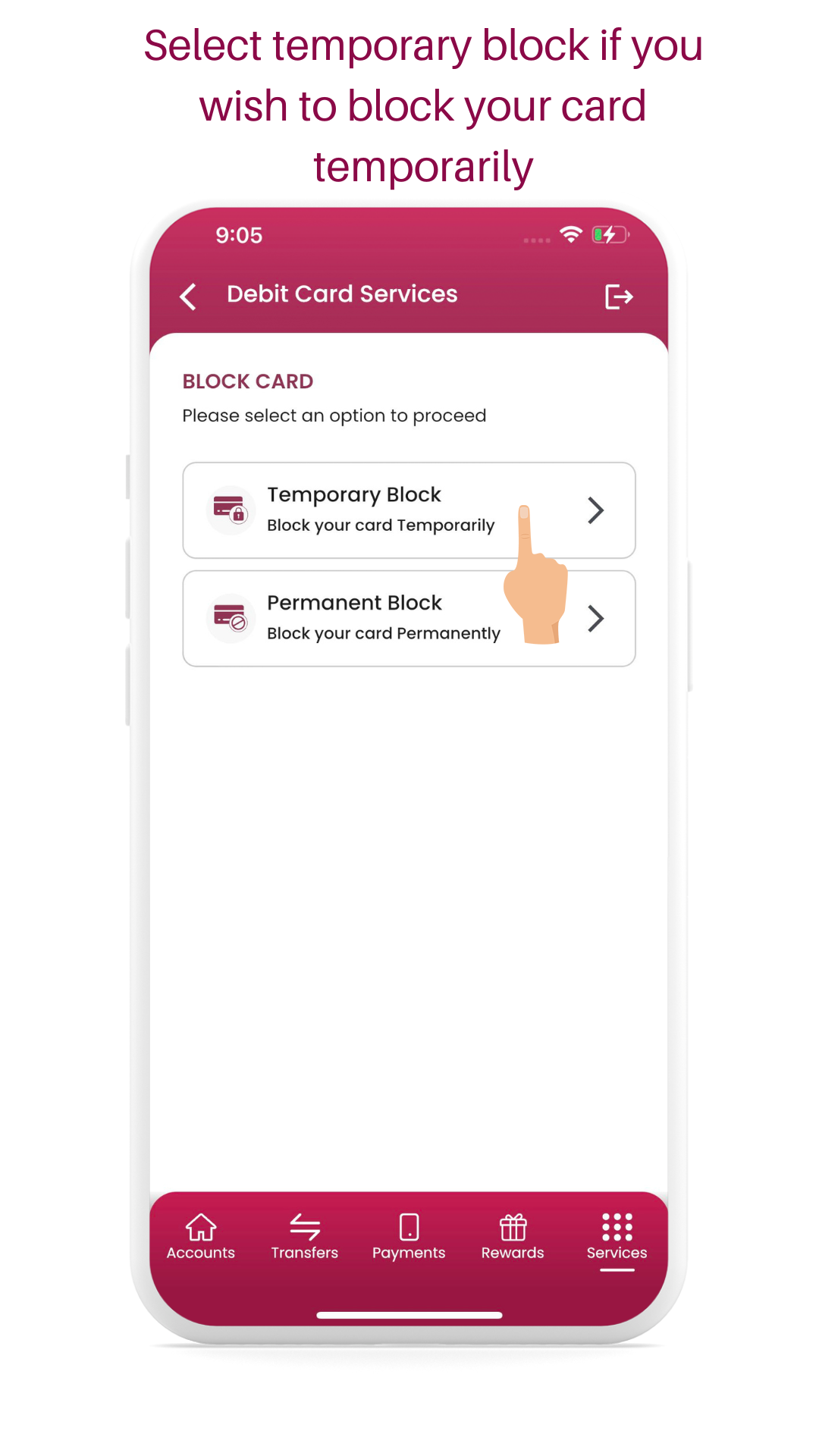

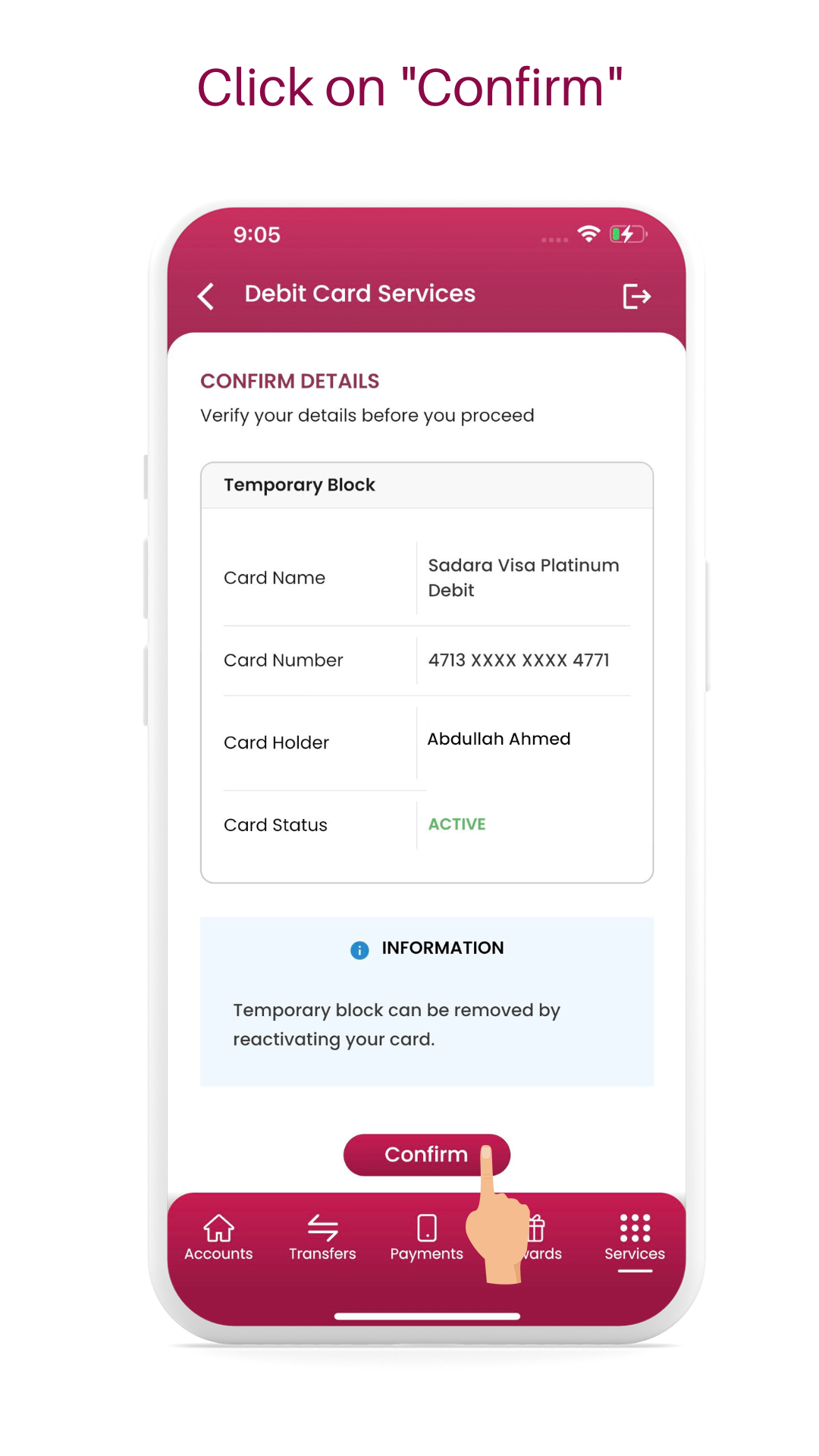

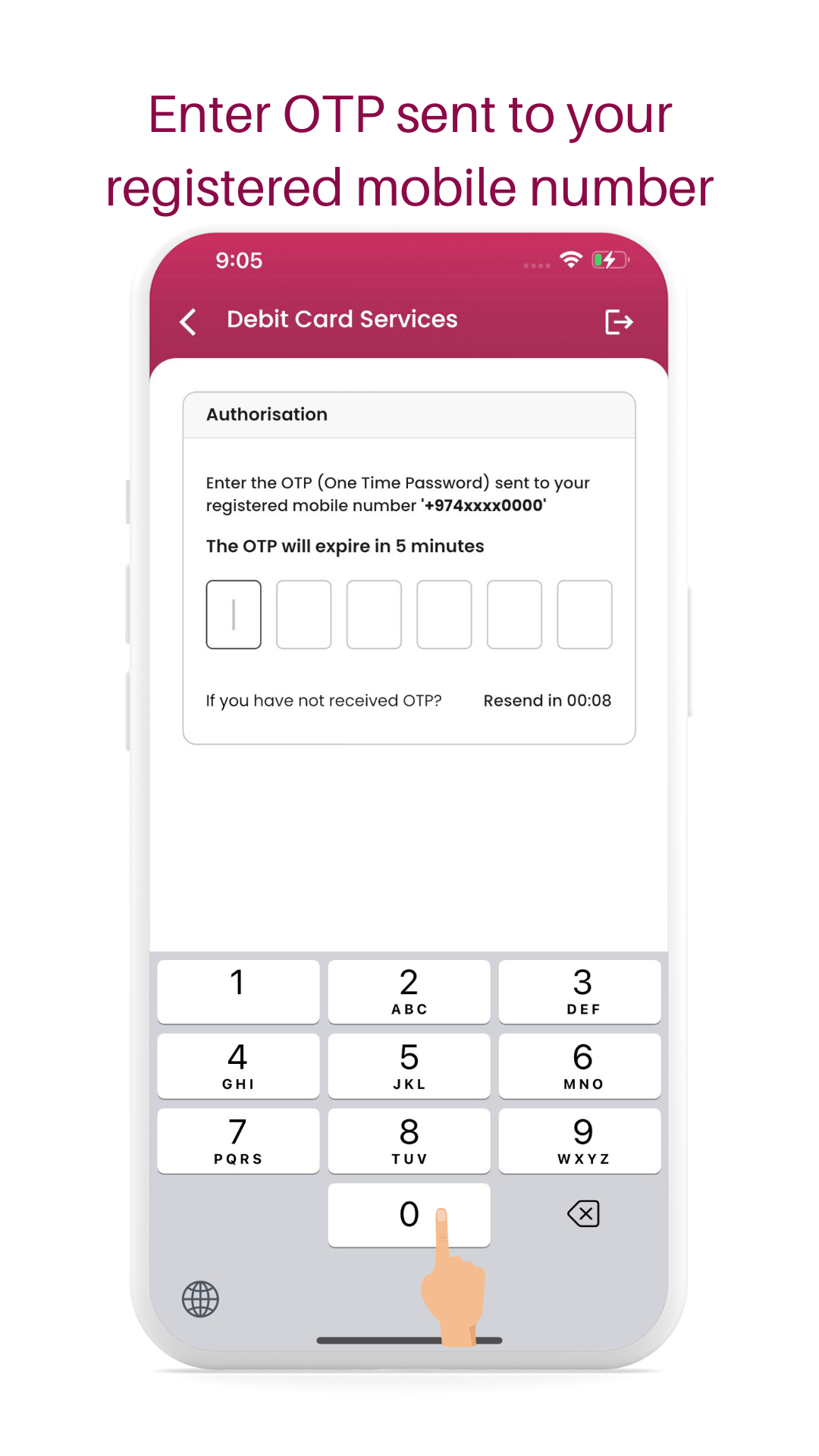

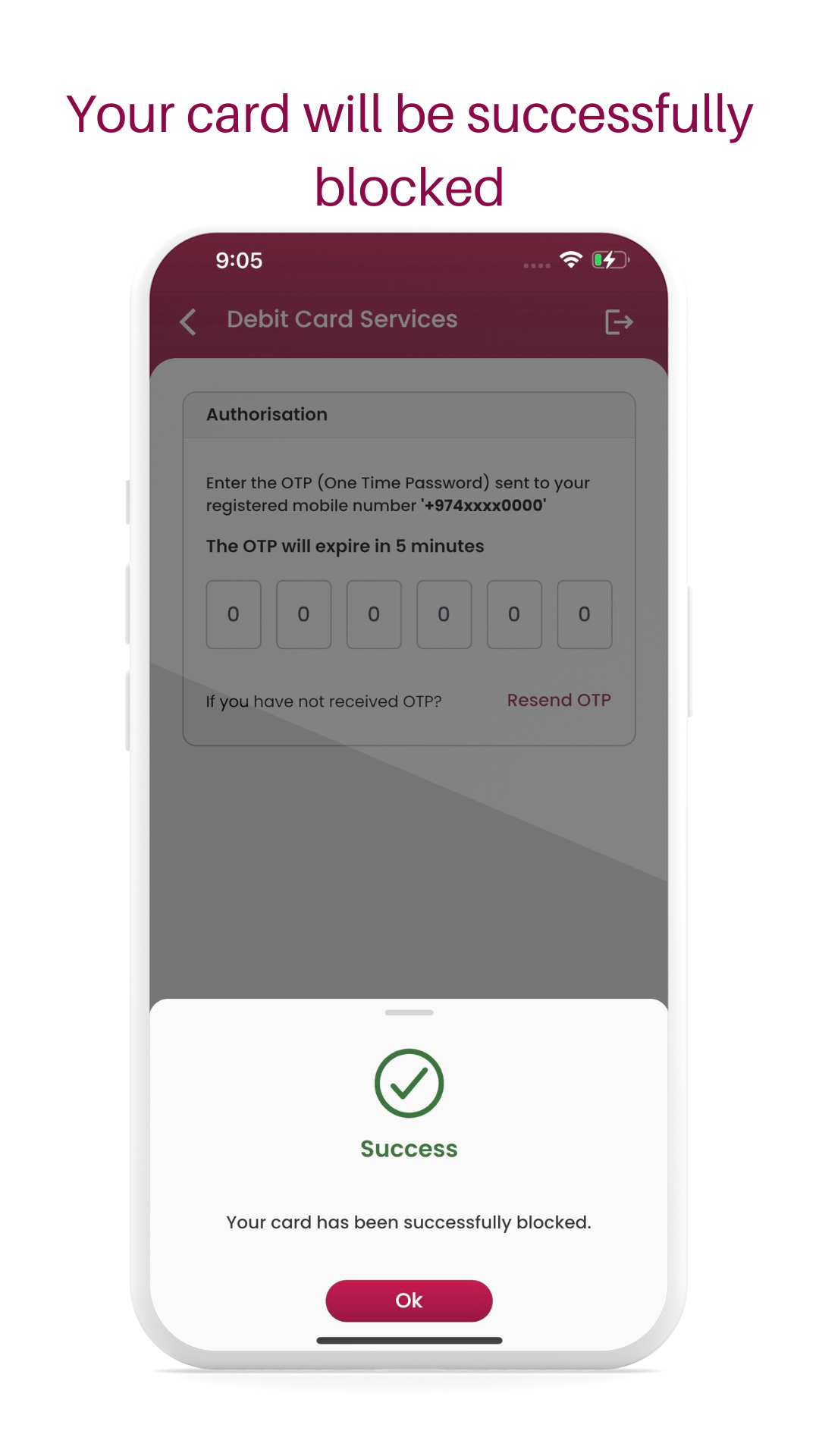

You can log in to RIB or MIB and select Credit Card Service option and block the card by following the screen prompts.

Outstanding balance refers to the total usage on your card including service fees. You can check your current outstanding balance using RIB or MIB, by calling our Contact Centre or through your Credit Card at the end of the billing cycle.

In order to close your card account the full outstanding balance including the installment balance. If there are any pending transaction that are yet to be billed to your account, the closure process cannot be initiated till the transactions are billed. Once the full outstanding amounts are settled, you can visit one of our branches or call our Contact Centre to initiate the closure process.

Your credit card will be automatically renewed 2 months in advance provided your card account is good standing. You will be notified to collect you card/print the card using our self-printing card kiosks.

Limit reduction on your supplementary card can be done on RIB or MIOB using the “Manage Limit “ functionality. IF the limit decrease is on the main card, please contact our Contact Centre.

Refunds and reversals can be tracked on your credit card statement using RIB or MIB or the statement generated at the end of the billing cycle.

Transaction reversal cannot be initiated by the cardholder. Cardholder must contact the merchant to reverse the transaction. In case of a technical failure of the transaction, the transaction will be automatically reversed to the car account.

• Check transactions posted on your statement are done by you or your supplementary cardholders.

• Check the payment due date and the minimum due amount.

• Check if you have overdue amount from previous month.

Converting the transaction post the purchase is called “EasyPay”. To complete an EasyPay transaction, the following must be met.

- Transaction value is greater than QAR 500.

- Transaction is billed to the account (not in pending status).

- Transaction is not statement i.e. your statement is not yet generated for that month.

If the above conditions are met, you can convert the transaction to 3, 6 or 12 months installment plans by using MIB. Log in to MIB, go to the card transactions. Select the transaction you want to convert and select Pay in installment function. For the fees and charges related to Easy Pay conversion please visit our tariff of charges on our website

Option 1. Log on to CBQ Mobile app > Click on the Rewards Credit Card > Click “CB Rewards” > View Points balance.

Option 2. Log on through website: www.cbqrewards.com > click on ‘my account’ to see points balance

Log on through website: www.cbqrewards.com > Click on Redeem Points > Select redemption category and proceed as per instruction on screen.

CB Rewards – All retail purchase transactions are eligible for rewards. CB Rewards are calculated as below :-

• Visa and MasterCard – Every QAR 20 will earn 1CB Reward point.

• Diners Club Cards – Every QAR 15 will earn 1 CB Reward point.

*For Government Merchants, customers will earn one point for every QAR 30 spent on Diners Card and QAR 40 spent on Visa or MasterCard.

• Limited Edition Rewards – All retail purchase transactions are eligible for rewards. Every QAR 70 will earn 1 Limited Edition Rewards points and rounded down.

*For transactions related to Government Merchants, you will earn one Limited Edition point for every QAR 140

Please Click here

• BuyNowPayLater(BNPL) – You can convert your transaction to easy monthly installment payments of 3,6, 12 or 24 months at our participating merchant partner outlets. Please click here to see the list of participating merchant partners.

• Convert to Installments (EasyPay) – You can easily convert your purchase to and installment plan of 3, 6 or 12 months using you Retail Internet Banking (RIB) or Mobile Internet Banking Application (MIB). To be eligible, the transaction value should be more than QAR 500 and conversion must happen before your statement is generated.

If you wish to early settle(accelerate) your pending installment transactions, please call our Contact Centre on 44490000.

All the remaining monthly installments will be debited to your current statement and become due on your Payment due date based on the payment percentage you have selected.

On a regular basis, we are proactively doing credit line increases to eligible customers. You will be notified via SMS if you are selected for limit increase program.

Please submit a limit increase request at your branch together with the recent standard/salary letter.

Credit Shield is a mandatory insurance cover on the Credit Cards to cover you against involuntary loss of employment. It also provided your coverage under extended warranty, Purchase & Price Protection. A nominal insurance premium is levied on the statement closing balance. To know more about Credit Shield terms and conditions and the insurance premium please click here and here

• Call For Credit - Commercial Bank can instantly transfer cash into your personal account if needed. This is a facility whereby you can request up to 95% of the available balance on your Credit Card which can be transferred to your personal account.

• Call for Cash/Dial for Cash - This is a facility whereby you can request cash from the available balance on your credit card.

• For more information about fees and charges relating these features please Click here.

You can use the Call for Cash facility to transfer the amount back to your Bank account

For security reasons and for regulatory reasons, some transaction blocks are in place. These steps are taken mainly to safeguard your credit card against unauthorized usage and fraudulent attempts. Using RIB and MIB “Credit Card Service”, you can activate your Travel Plan to allow usage when you are overseas.

To know your annual fee on your credit card package please visit the schedule of charge by clicking here

• Please ensure all the obligations are settled including the pending transaction which were not yet billed to your card account.

• Apply for a clearance letter using a duly signed form at one of our Branches.

You can update your Billing/Statement address through our Branches or Contact Centre.

All Insurance claims under Credit Shield are centrally processed via our Collections Department.

Booking will be held for 15 days.

Please click here to check if the airport lounge is participating in the program. Make sure you Diners Club Card is in good standing.

Make sure you Diners Club Card is in good standing.

Diners Club Airport Lounge Access is valid for the cardholder. Any additional guest will be charged the prevailing access fee published by the lounge.

• Please ensure if your mobile number is correctly updated.

• Ensure the online/e-commerce merchant is participating in the 3D secure transaction platform.

Your credit card can go over limit for different reasons like merchant submitting the transaction late, merchant submitting a transaction without or old authorization, fees and charges etc. If the over limit amount is greater than 2% of the credit limit an over limit fee is levied to the card account.

/crsimage.png?h=350&iar=0&w=1200&hash=0DA1B4CFB9B438CAEC3219A0155709D6)