Mobile & Internet Banking

At Commercial Bank, we are committed to enhancing your banking experience by providing fast, convenient, and secure services. Our Mobile Banking and Internet Banking platforms, empower you to oversee your finances effortlessly, no matter where you are. Experience banking at your convenience, ensuring that your financial requirements are efficiently and accurately met.

Why Digital Banking?

Mobile Banking:

Our CBQ Mobile Banking App is more than just a tool for checking your bank accounts, monitoring your Credit Card spending, paying utility bills, transferring funds locally, remitting money overseas, inquiring and paying your Ooredoo /Vodafone bills, top-up/buy Ooredoo /Vodafone airtime vouchers online, pay merchant bills and view all your transactions as they occur, apply for new accounts and credit cards instantly.Upon sign-up, you will also gain access to the full suite of digital services, making your banking experience seamless and efficient.

Choose to Click

Frequently Asked Questions

Commercial Bank supports the following login options:

- Using your username & password credentials

If you wish to reset your password, kindly use the “Forgot Password" option available on the login page.

- Using Biometrics login along with card PIN. To enable Biometrics login , kindly follow the below steps:

Please ensure that your fingerprint/face ID is registered on your device.

Select Biometrics registration available under services option and complete the registration process.

You can register for Fingerprint/ Face ID login on your device by following the below steps:

- Register your Fingerprint/Face ID with the device.

- Login to your CBQ Mobile App using your existing username and password.

- Select the 'Fingerprint/Face ID Registration' option available under ‘Services’ menu.

- From the list of cards, select the card of your choice and enter the PIN number.

- Enter the One Time Password (OTP) sent to your registered mobile number.

Devices with the following operating system versions support Biometric Login:

- Android version 8 and above

- IOS version 15 and above

In order to deactivate the Fingerprint/ Face ID login feature in your device, please follow the below steps:

- Login to your account via CBQ Mobile App or Internet Banking.

- Click on “Services".

- Click on “My Devices".

- A page will be displayed with all your registered devices.

- Click on the “Delete” option available beside “the device you wish to deactivate”.

- Enter the OTP sent to your registered mobile number.

- Your biometric details on the selected device will be deleted.

Features at a glance

/ways2bank-main-banner/ways2bank-main-banner-(1)/mobile-banking.jpg?h=700&iar=0&w=2400&hash=AE32EE264D16A83371C7CF4C02F15E34)

Internet Banking

Experience Convenience

We invite you to experience the future of banking by visiting our Internet Banking and get instant access to your finances from the comfort of your own laptop or take control of your finances with the power of digital banking today.

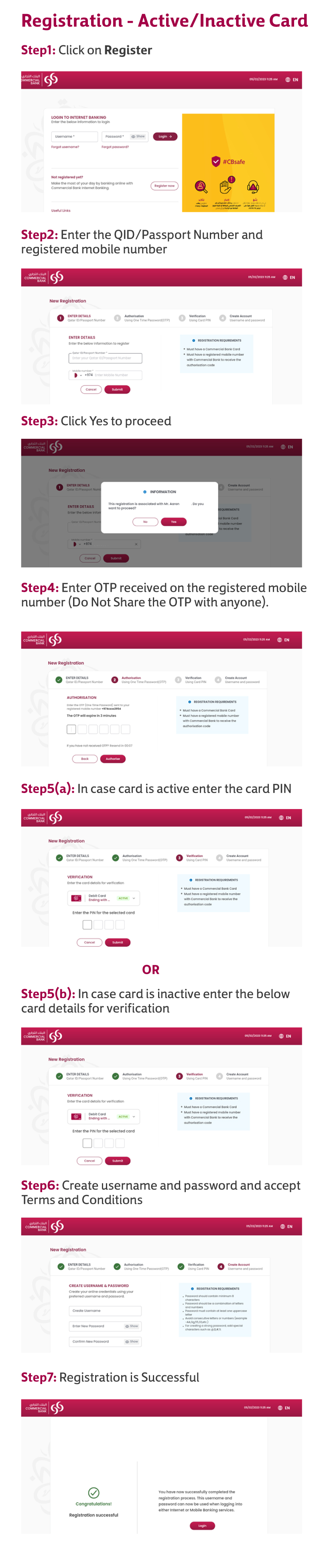

How to Register?

Why Internet Banking?

Our digital banking channels offer you a comprehensive suite of services that cater to your financial needs. Some of the key services include:

List of existing banking services available online:

- Change Language

- Register

- Password Login

- Forgot Username

- Forgot Password

- Biometric Login

- CBsafe ID

- Locate Us

- Security Tips

- CB Offers

- Support

- Emergency Block

- My Goals

- Statements

- Copy IBAN

- Share QR Code

- Share IBAN

- Request IBAN Letter

- View Transactions

- Download and Export transaction details

- Raise /Track Dispute

- RM Details (for CB Premium Banking customers)

- Favourites

- Profile Picture

- International Transfer

- Local Transfer / Fawran

- Between My CB Accounts

- Exchange Rates

- Manage Transfer Limits

- Scheduled Funds Transfer

- Manage Standing Orders

- Create Exchange Rate Alert

- Transfer History

- Request for Information

- Ooredoo

- Vodafone

- Kahramaa

- Qatar Cool

- School Payments

- Club Membership

- Insurance

- Charity Payments

- Send e-Gift

- Mobile Payment Request

- Mobile Cash

- Household PayCard

- Merchant Payment

- Cash Advance

- Quick Cash

- Payment History

- Schedule Payment

- Qatar Post

- My CB Rewards

- Spend Pattern

- Card Offers

- CB Coupon

- Register FingerPrint/FaceID

- Change Language

- Dashboard Options

- My Devices

- Change Login Username

- Change Login Password

- Mobile App Version

- Manage Font Settings

- Profile Update

- Additional Account Opening

- Order Cheque Book

- Enquire Service Request Status

- Digital Cheque Deposit

- Alternatif Bank Accounts

- Deposit Closure

- Branch Visit Appointment

- Apple Pay / CB Pay

- Emergency Block

- Credit Card Services

- Debit Card Services

- Prepaid Card Services

- Travel Plan

- Convert to Installments

- Apply Virtual / Prepaid Card

- CBsafe ID

- Exchange Rates

- ATM/Branch Locator

- Subscribe To eStatement

- CB Trading

- Risk Profiling

- IPO Subscription

- Request For Liability/Clearance Letter

- Travel Insurance

- Report a fraud

- Raise/ Track dispute

- Write To Us

- Call Us

- Frequently asked Questions

- Terms & Conditions

- Security Tips

- Product Offers

/ways2bank-main-banner/ways2bank-main-banner-(1)/digitalbankingscene.png?h=700&iar=0&w=2400&hash=0F3A98898D6612B89A408BD23E649E39)

.png?h=512&iar=0&w=512&hash=63F3CCC602CD753F9E80E0574E9732A4)

.png?h=512&iar=0&w=512&hash=2FCDD55F4242BC599209FDDDA142678F)

/cyber-security.png?h=512&iar=0&w=512&hash=3E5BC6B0F8A47DEBAA9A74E3BB401194)

.png?h=512&iar=0&w=512&hash=2664CAC77B5B883950DB3D549429ADCD)

/credit-card-(2).png?h=512&iar=0&w=512&hash=8C827C73DD9424E2920D8A07E98A5C32)

.png?h=512&iar=0&w=512&hash=CB3B377AD559BE0687D20F2498AEFC4A)

.png?h=512&iar=0&w=512&hash=2CE10623DADA75337B1B5F522E9AE144)

/monitor.png?h=512&iar=0&w=512&hash=8523B368DCD7C18530058A2B33D1AE66)

/good-conversion-rate.png?h=512&iar=0&w=512&hash=B1E975F42EE30B8682E0170BA5550002)