The Commercial Bank Financial Results For The Nine Months Ended 30 September 2024

16 October 2024

Doha, Qatar, 16 October 2024:

The Commercial Bank (P.S.Q.C.), its subsidiaries and associates (“Group") announced today its financial results for the nine months ended 30 September 2024.

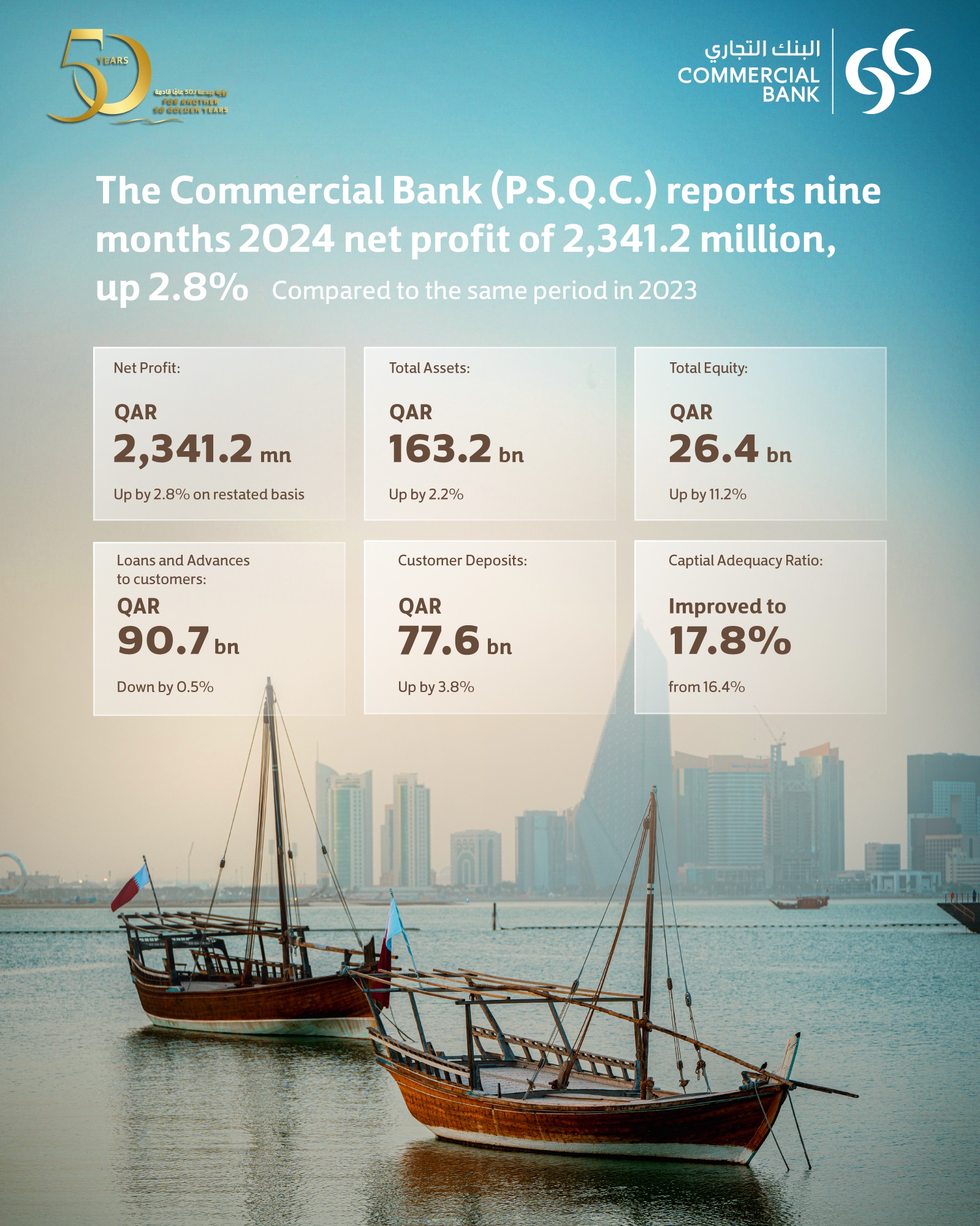

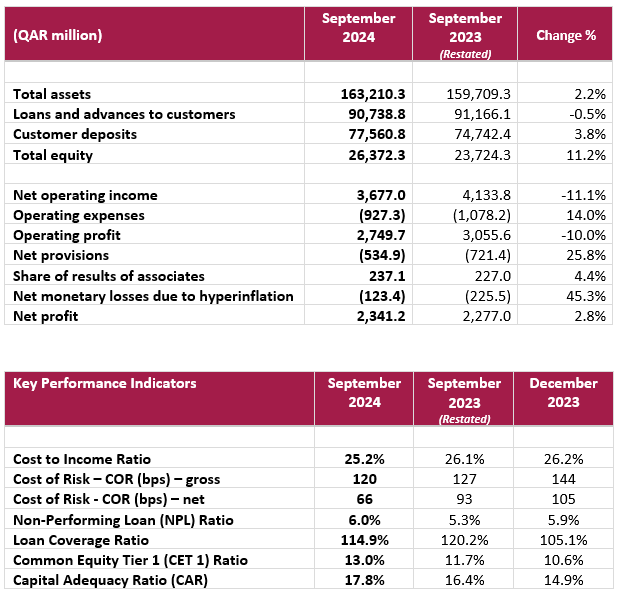

The Group reported a net profit of QAR 2,341.2 million as compared to last year's reported net profit of QAR 2,365.4 million for nine months 2023 which was restated to QAR 2,277.0 million for the same period in 2023, representing a 1.0% decrease on a reported basis and a 2.8% increase on a restated basis. The result highlights the steady progress made on our path of growth and innovation.

The nine months 2023 numbers were restated due to the restatement of the year-end 2023 financial statements for the underlying derivative on the share option performance scheme. Accordingly, the current nine months 2024 figures provided are compared with the previous year restated numbers.

Sheikh Abdulla bin Ali bin Jabor Al Thani, Chairman, said,

“Throughout the first nine months of 2024, Commercial Bank continued to execute its strategic plan, achieving a positive net profit growth. Further, the Bank has made good progress towards its sustainability efforts which is core to Commercial Bank's strategy in line with the Qatar National Vision 2030 and National Environment and Climate Change Strategy. Last month MSCI upgraded Commercial Bank's ESG rating from BBB to A and we continue to enhance our ESG practices across the Bank in accordance with best international standards. We remain committed to a resilient and sustainable financial future."

Mr. Hussain Alfardan, Vice Chairman, said,

“Commercial Bank has shown steady progress in the first nine months of 2024, supported by Qatar's economic momentum and our focus on operational efficiency. Our disciplined cost management has maintained our cost-to-income ratio to acceptable levels, and growth across key segments reflects our commitment to meeting customer needs. The recent issuance of our inaugural Green Bond, raising CHF 225 million underscores our dedication to sustainable finance and to driving impactful green projects in Qatar."

Mr. Joseph Abraham, Group Chief Executive Officer, commented,

“Commercial Bank delivered a resilient performance in the first nine months of 2024, aligning with our strategic objectives and demonstrating positive financial results. We recorded a consolidated net profit of QAR 2,341.2 million, a 2.8% increase year-on-year, driven by lower operating costs, lower net provisions, and improved associate performance.

Despite a decline in net interest income due to higher market funding costs, our core fee income grew by 10%, reflecting strengthened focus on transaction banking, cards, and wealth management.

We continue to optimize our balance sheet, evidenced by a 2.2% increase in total assets. Additionally, our strategic capital market issuances, including a successful issuance of CHF 225 million Green Bond, underscore investor confidence in our financial health and commitment to sustainable growth. Our capital position remains robust with Common Equity Tier 1 ratio at 13.0% and Capital Adequacy Ratio at 17.8% underlining strong capital accretion as the Bank continues to grow in line with the guidance.

Looking ahead, we remain committed to executing our long-term strategy and supporting Qatar's National Vision 2030 through responsible banking and sustainable financing."

Key indicators of the financial results for the nine months period ended 30 September 2024 were as follows:

Financial Highlights

Balance sheet: Total Assets as at 30 September 2024 reached QAR 163.2 billion, an increase of 2.2% from 30 September 2023. This is mainly driven by increase in due from banks, where lending to financial institutions have increased. The loans and advances to customers is at QAR 90.7 billion, down by 0.5% due to repayments by government & public sector borrowings. Diversified customer deposits generation helped to increase customer deposits by 3.8% to reach QAR 77.6 billion from 30 September 2023.

Income statement: Net profit for the nine months ended 30 September 2024 reached QAR 2,341.2 million, an increase of 2.8% on restated basis, compared to same period last year. The overall growth in reported profitability was driven mainly by lower operating cost, lower net provisions and improved performance from our associates. The Group's cost-to-income ratio improved to 25.2% from 26.1%. The overall growth demonstrates the Group's steady financial performance and resilience despite market challenges.

Credit quality: The ratio of non-performing loans to gross loans stood at 6.0% as at 30 September 2024 compared to 5.3% as at 30 September 2023, due to lower loan balances. During the period, the Group's net provisions fell to QAR 534.9 million for the nine months ended 30 September 2024, from QAR 721.4 million in the same period in 2023, due to higher recoveries and ECL release. Also, Loan coverage ratio is at 114.9%, demonstrates the Group's prudent approach and strategy towards managing non-performing loans. The Group's strategy focuses on maintaining asset quality and reflecting commitment to sustainable financial health.

Capital ratios: The Group's Common Equity Tier 1 (CET 1) Ratio as at 30 September 2024 reached 13.0%. The Capital Adequacy Ratio (CAR) as at 30 September 2024 stood at 17.8%, underlining strong capital accretion. These ratios are higher than the regulatory minimum requirements of the Qatar Central Bank and Basel III requirements.

Credit ratings highlight the Bank's robust resilience

During 2024, Fitch and Moody's affirm Commercial Bank's credit ratings to “A" and “A2" respectively, with a stable outlook.

The rating from Fitch reflects potential support from Qatari authorities, as shown by the Government Support Rating of 'a', with a Stable Outlook mirroring Qatar's sovereign rating (AA/Stable). According to Fitch, Commercial Bank's strong rating is driven by a stable domestic operating environment, a robust domestic franchise, and improving profitability.

Moody's maintains a stable outlook for Commercial Bank, expecting its capitalization and liquidity to remain resilient despite challenges like asset quality pressures and reliance on external funding. This strong rating is attributed to the Bank's profitability, operational efficiency, sufficient capital buffers, healthy liquidity, and the likelihood of support from Qatari authorities if necessary.

The Commercial Bank's top-tier ratings reflect confidence from institutional, corporate, and retail clients in its financial performance and strategic outlook. This solid financial position assures investors and market participants of the Bank's capacity for sustainable growth and success.

Diversified funding sources

During the nine months period ended 30 September 2024, Commercial Bank in first quarter successfully priced a USD 750 million Regulation S 5-year Bond which was oversubscribed 2.40 times, listed in Euronext Dublin. The deal marks Commercial Bank's successful return to the public international capital markets after a hiatus of 3 years and attracted high-quality and diversified orderbook comprised of some of the largest and most notable EM investors as well as real money accounts and sovereign wealth funds.

Further in second quarter, Commercial Bank has successfully closed a 3-year USD 500 Million Syndicated Term Loan Facility. The transaction received strong interest from the market and was significantly oversubscribed 2.30 times, demonstrating investor confidence in Commercial Bank's financial performance and management, as well the strength of the Qatari economy.

In the third quarter, the Bank successfully issued Green Bond for CHF 225 million for 3 years at a coupon rate of 1.7075% following strong demand from a range of institutional investors.

Sustainability and green financing for a resilient future

Commercial Bank is committed to the Qatar National Vision 2030 which aims to transform Qatar into an advanced society capable of achieving sustainable development by 2030 through four interconnected pillars: environmental, economic, social, and human development. In 2023, the Bank established its inaugural Sustainable Finance Framework. The Framework was externally assessed and validated through a Second Party Opinion from Sustainalytics.

In 2024 the Bank issued our debut Green Bond for CHF 225 million for 3 years at a coupon rate of 1.7075% following strong demand from a range of institutional investors. The issue was the largest ever CHF Green bond issued in Qatar, the largest CHF issuance out of Qatar since January 2013, and the largest CHF Green bond issued out of CEEMEA since 2021.

The Bank expects to allocate proceeds to categories such as Sustainable Water and Wastewater Management, Green Buildings and Clean Transportation, which is expected to contribute towards achieving the goals of Qatar National Vision 2030 and Qatar's National Environment and Climate Change Strategy.

The Bank's MSCI ESG rating was upgraded from “BBB" to “A" in August 2024.

Driving value creation through strategic partnerships and recognition

The Bank maintains a strong geographical presence, as the 100% owner of Alternatif Bank in Turkey, along with strategic partnerships with National Bank of Oman and United Arab Bank in Oman and the UAE, respectively. With its consistent performance, supported by regional strength and international reach, the Bank has been recognized by Forbes as one of the top 30 Most Valuable Banks in the Middle East for 2024. This recognition underscores the Group's continued commitment to effectively serving its diverse customer base.

The Group also received a number of prestigious awards during this period:

- Best Mobile Banking App award in the Middle East by MEED

- Best Remittance Service award in the Middle East by MEED

- Fastest Growing Credit Card Issuer award in Qatar by International Finance.

- The Best Card Payment Service POS/ATM award in Qatar by International Finance.

- Best Contact Centre award in the Middle East by Gulf Customer Experience Awards.

- Best Mobile Banking App in the Middle East by Global Finance

- Best Mobile Banking in Qatar by Global Finance.

About Commercial Bank

Commercial Bank, incorporated in 1974 as the first private bank in the country, celebrates its 50th anniversary this year. It stands as one of Qatar's leading financial institutions, with a profitable track record since its inception, and is the second-largest conventional bank in Qatar. Today, the Bank continues to play a pivotal role in driving innovation and raising banking service standards across the region through investment in new technology, a strong customer focus, and prudent management.

For further information, visit: Investor Relations | Commercial Bank of Qatar (cbq.qa)

For investor-related queries, please contact CB Investor Relations team on ir@cbq.qa