.png?h=900&iar=0&w=2000&hash=03BF420535713D81509995F782B871C0)

Key benefits and highlights

CB Rewards

Earn CB Rewards on spends:

- You will earn one point for every QAR 20 spent using your Titanium Credit Card.

- You will earn one point for every QAR 15 spent on Diners Club Credit Card.

- No Cap on CB Rewards earning.

- You are eligible for 5,000 CB Reward Points worth of QAR 500.

- Terms & Conditions apply .

Local Merchant Offers and Discounts

- Exclusive offers and deals on travel, lifestyle, shopping and more. For more information, please click here.

- BNPL plans at select Merchant Outlets.

- Buy 1 get 1 offer on tickets at Novo Cinemas.

Travel Benefits:

- Priceless™ Cities

- Titanium Dragon Pass Lounge Program

- IHG Hotels and Resorts

- Booking.com

- Rentalcars.com

- Avis car rental discounts

- Budget Truck & Car Rental

- Medical Tourism Concierge

Lifestyle Benefits:

- Discounted chauffeur rides with Careem

- Food and grocery delivery discount with Talabat

- MyUS shipping premium membership

- Gamer Pass with Go Gamers

- MyBook Qatar Buy 1 Get 1 Offers

- Lingo kids discounts

- Fiit subscription

- NOVO cinema Buy One Get One

Joining Bonus Reward Points

You are eligible for 5,000 CB Reward Points worth of QAR 500 if your retail spend reaches (excluding Buy Now Pay Later, Cash Advance transactions & any fees/charges) QAR 5,000 within 90 days of card activation.

The joining bonus reward points have a validity period of 90 days from the date of credit.

Commercial Bank joining bonus reward points are given only once (i.e., if you cancel your card and reapply, you will not be eligible for joining reward bonus points).

Joining bonus points are awarded on eligible Retail POS and e-commerce transactions excluding transactions done with Government Merchants, Dynamic Currency Conversion, Charities, Insurances, and all European Union Card present transactions.

CB Reward Points

You will earn one point for every QAR 15 spent on Diners Card and QAR 20 spent on Mastercard on retail purchase transactions excluding transactions done with the categories below for Commercial Bank Titanium, Platinum, and Sadara Credit Cards:

- Dynamic Currency Conversion (DCC).

- All Government Merchant Category Codes (MCC) including Qatar General Electricity & Water Corporation (KAHRAMAA) and (Qatar Cool).

- All Charity related Merchant Category Codes (MCC).

- All Insurance related Merchant Category Codes (MCC).

- All European Union Card present transactions.

- POS and E-commerce transactions made locally in Qatar (with Qatar currency) through merchants listed outside of Qatar will not qualify for reward point earnings.

*Terms and conditions apply.

CB Reward Points have a validity of 24 months from the date of credit.

CB Reward Points can be easily redeemed for instant Avios, flights & hotels stays, Rent-a-Car, and many other shopping vouchers. For more information please visit cbqrewards.com.

Complimentary Lounge Access

DragonPass

Enjoy Complimentary access to over 25 regional and international airport lounges up to 6 times per year, when you spend a minimum of USD 1 internationally every 3 months, Download the Mastercard Travel Pass app, to access lounges across UAE, Saudi Arabia, Qatar, Jordan, Kuwait, Egypt, Morocco, USA, UK, Canada, Germany, France, Singapore, and more., While you sit back and relax, you’ll also get access to business facilities for email, internet, phones, fax machines and conference space in some lounges, as well as complimentary refreshments and snacks.

And because your convenience and comfort are a top priority to us, we are giving you 1 complimentary lounge access each year without conducting the minimum spending requirement.

To get your complimentary airport lounge access with Mastercard Travel Pass App, simply follow the below steps:

- Download the Mastercard Travel Pass app.

- Register your Mastercard card securely.

- Use the app to locate lounges near you.

- Confirm complimentary visits eligibility.

- Present the app QR code to the lounge receptionist.

- Enjoy your lounge access.

Diners Club Lounges

Your Diners Club Card entitles you to Diners Club airport lounges worldwide at free of cost. However, any guest that accompanies you will be subject to charges as per lounge pricing guide

For the list of airport lounges please click here.

Starting 1 June 2024, your Commercial Bank Diners Club Credit Card will only entitle you to 1 complimentary access per year to Diners Club airport lounges worldwide.

Eligibility:

- Age between 18 to 65 For Qataris

- Age between 18 to 60 for Expats

- Monthly salary needs to be a minimum of QAR 7,500, transferred to your Commercial Bank Account.

Annual Fee:

- Annual Fees: *QAR 600 (Waived for first year).

*Spend a minimum of QAR 30,000 using your card during the first year on daily purchases

(excluding Buy Now Pay Later transactions, cash advances, reversed/refunded transactions, and any fees or charges) to qualify for a waiver of the second-year annual fee of QAR 600.

The Card may be activated through the available Channels. We may activate your Credit Card upon acknowledgement of receipt of the Card. The annual fee associated with your Credit Card will be charged to your account upon activation of the card, regardless of the time elapsed since the card was issued. If activation is delayed, the fee will still be levied at the time of activation.

By applying for and accepting this Credit Card, you acknowledge and agree that the annual fee is non-refundable and will be charged upon activation, irrespective of any delay in activation on your part.

Frequently Asked Questions

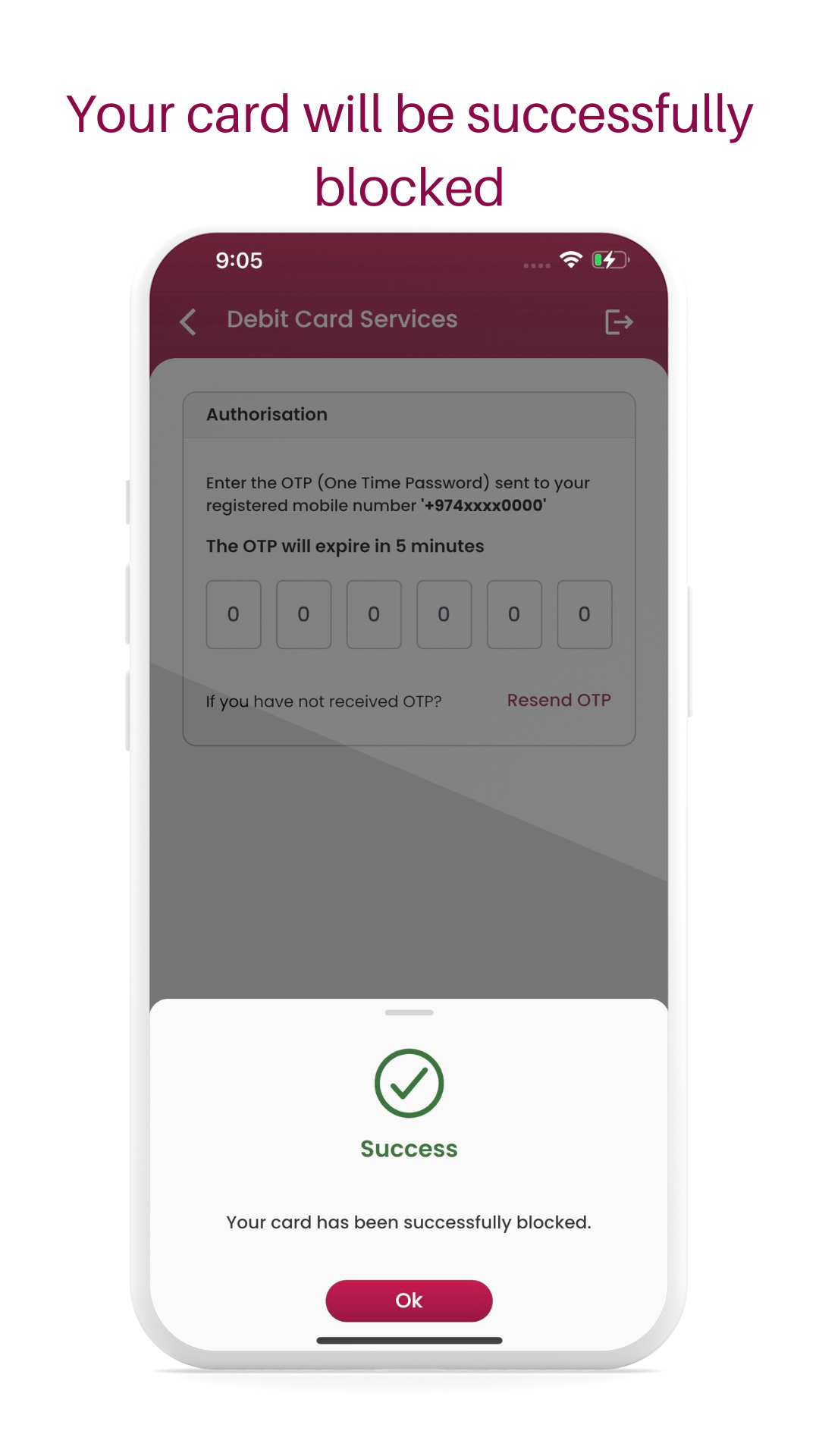

If your card is lost or stolen, you should immediately block the card permanently and order a replacement. You can block and replace your card in multiple convenient ways.

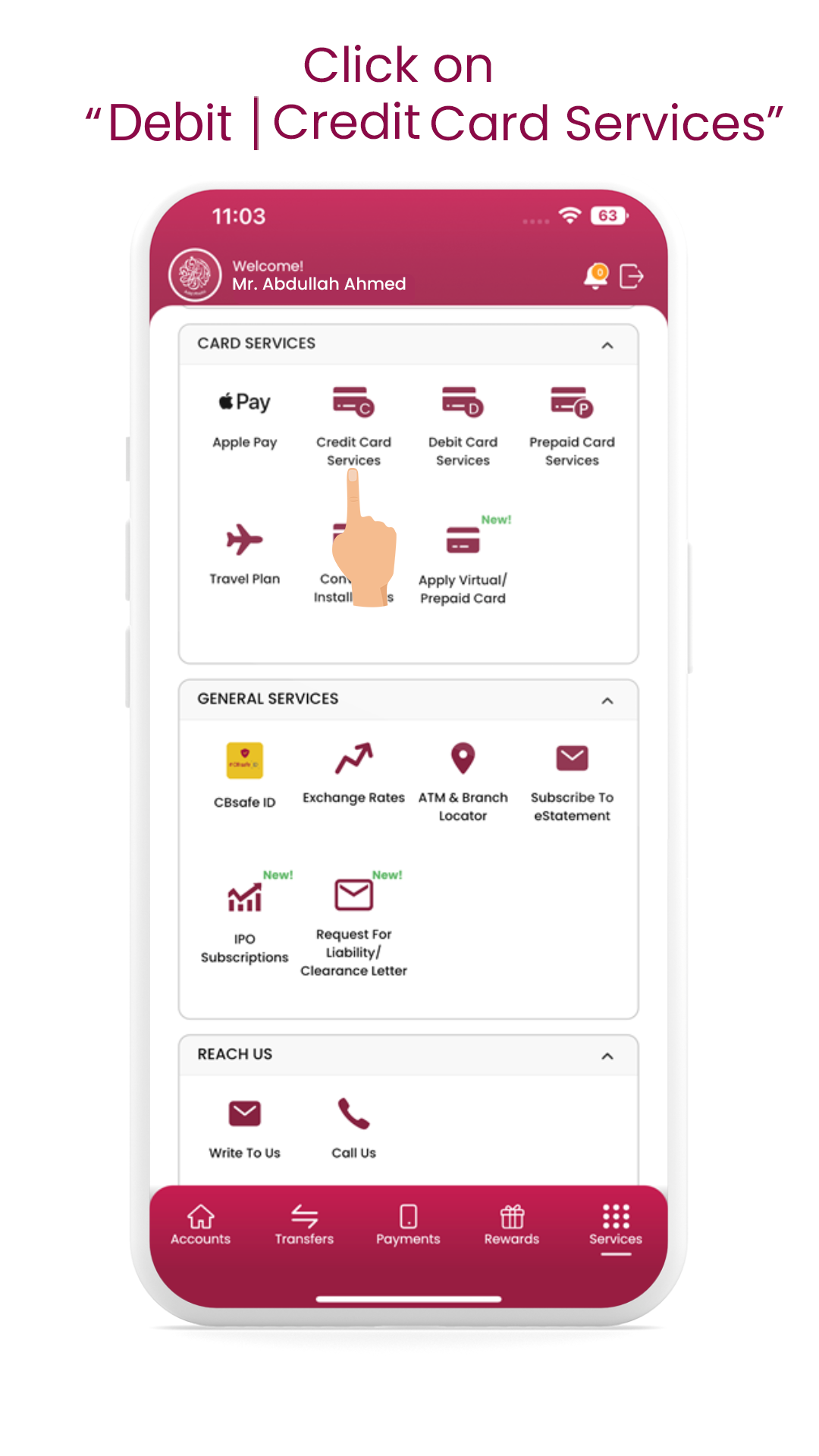

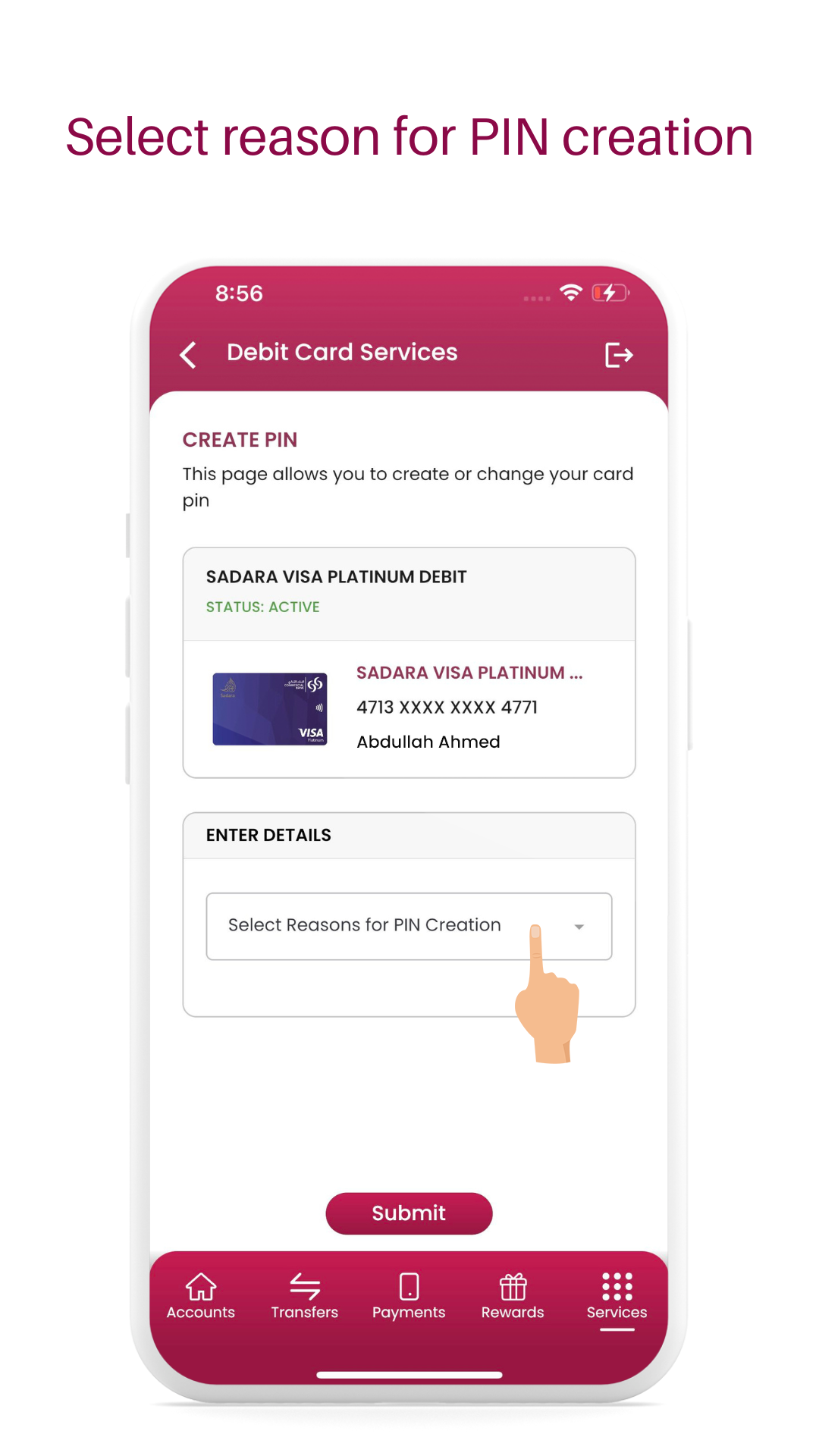

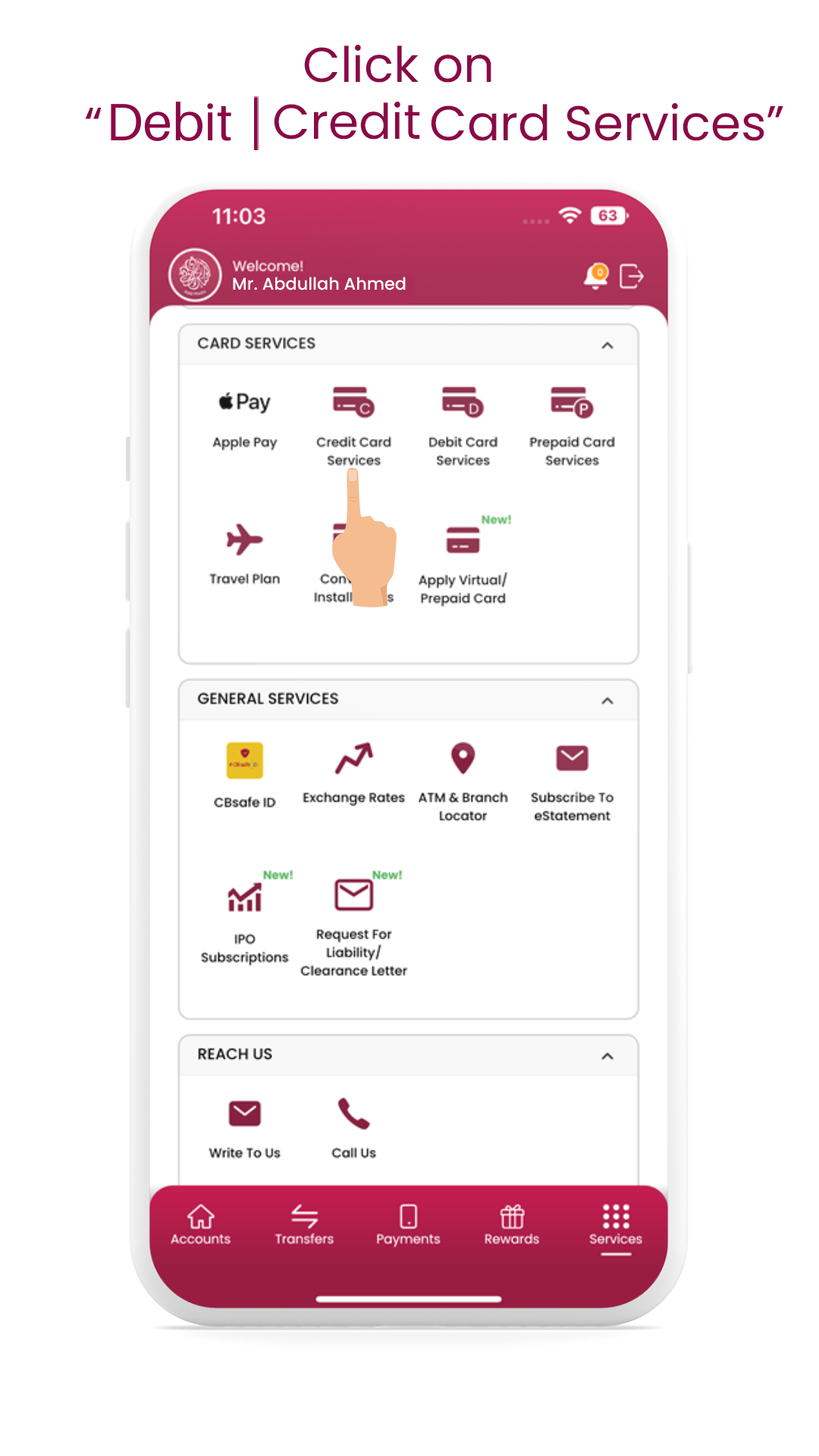

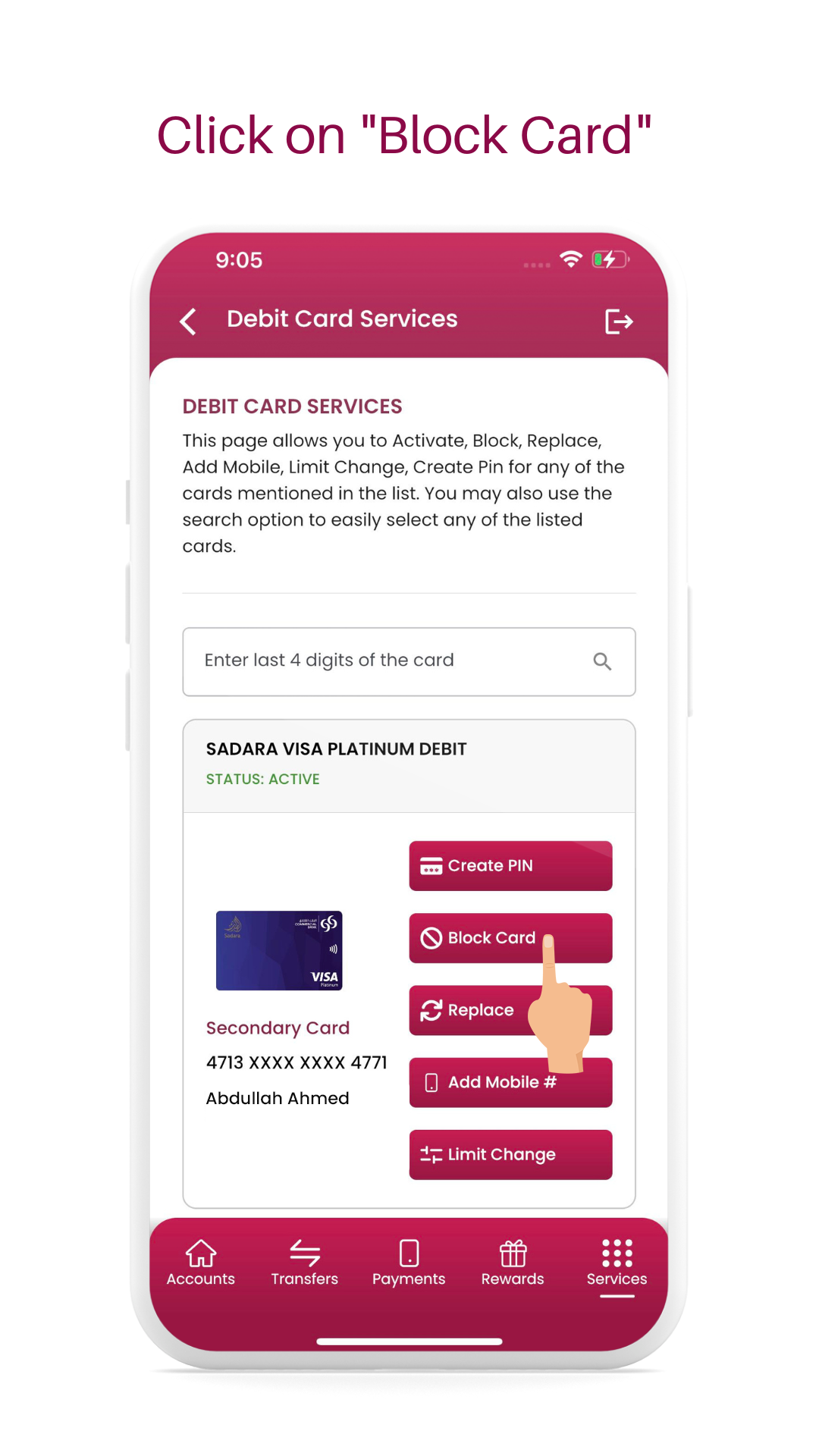

CBQ Mobile App or Internet Banking

- Login to CBQ Mobile App or Internet Banking.

- Select the “Services” tab.

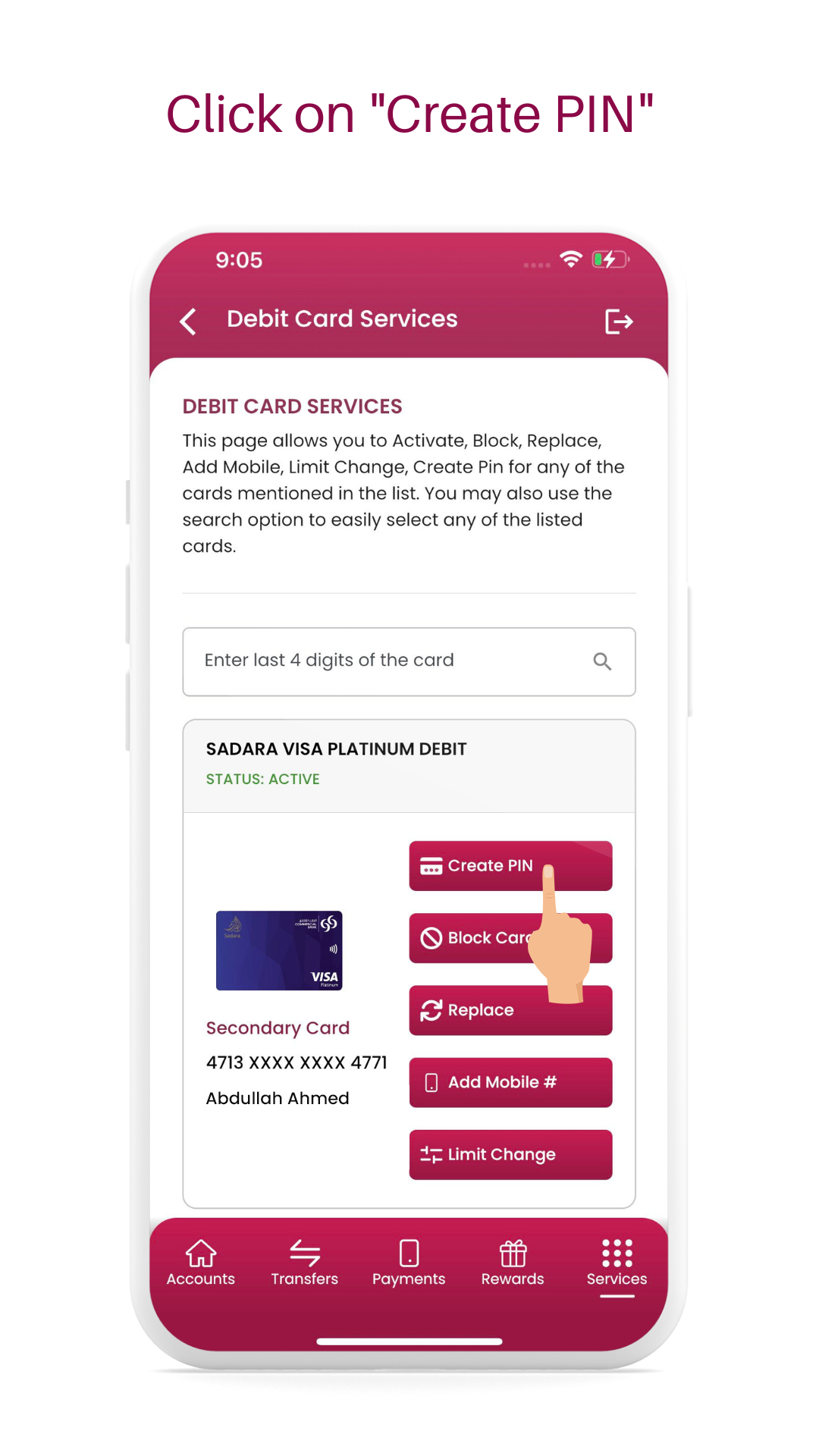

- Under menu, click on the “Debit Card Services” or “Credit Card Services”.

- Choose the appropriate card to be blocked.

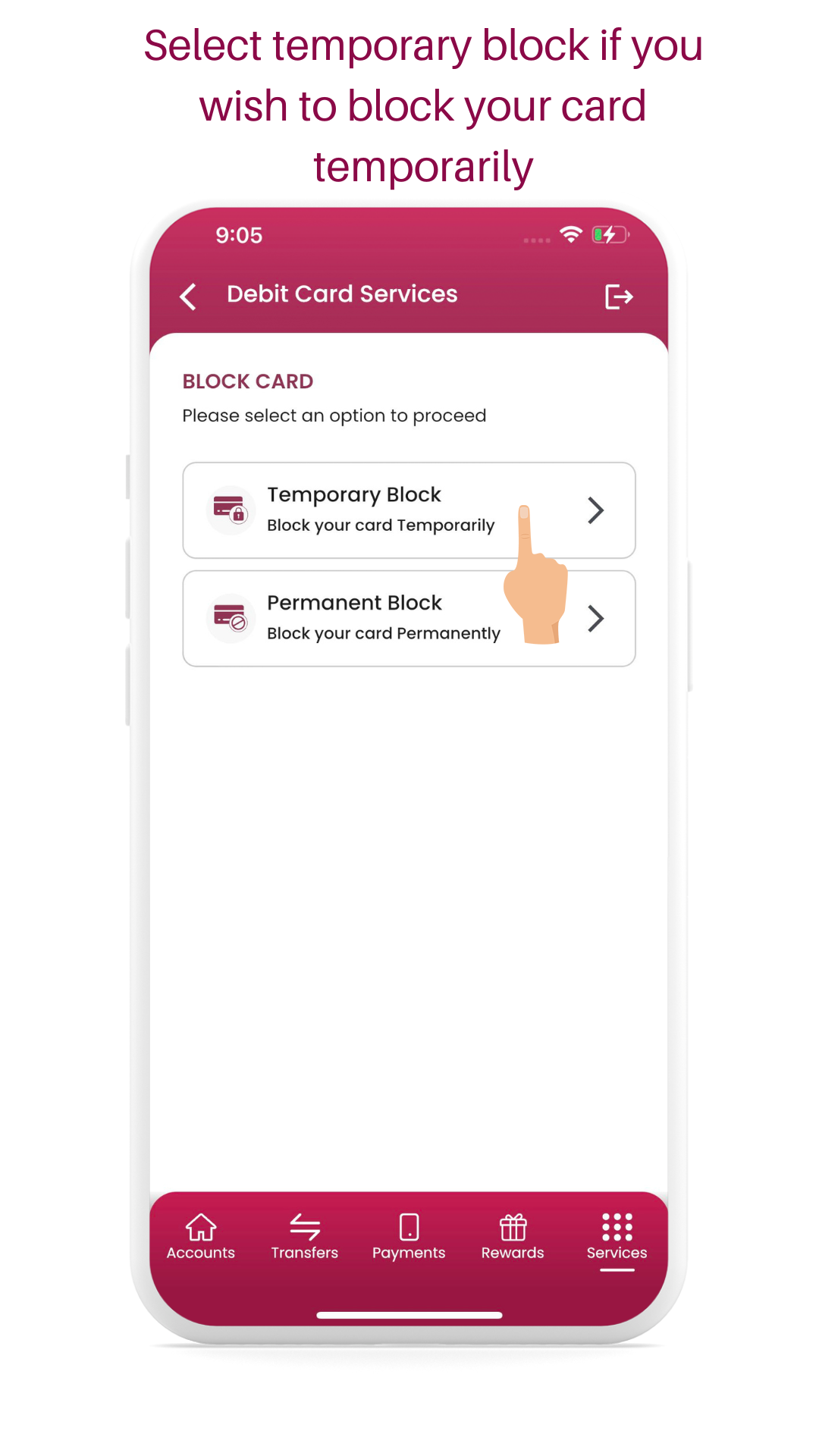

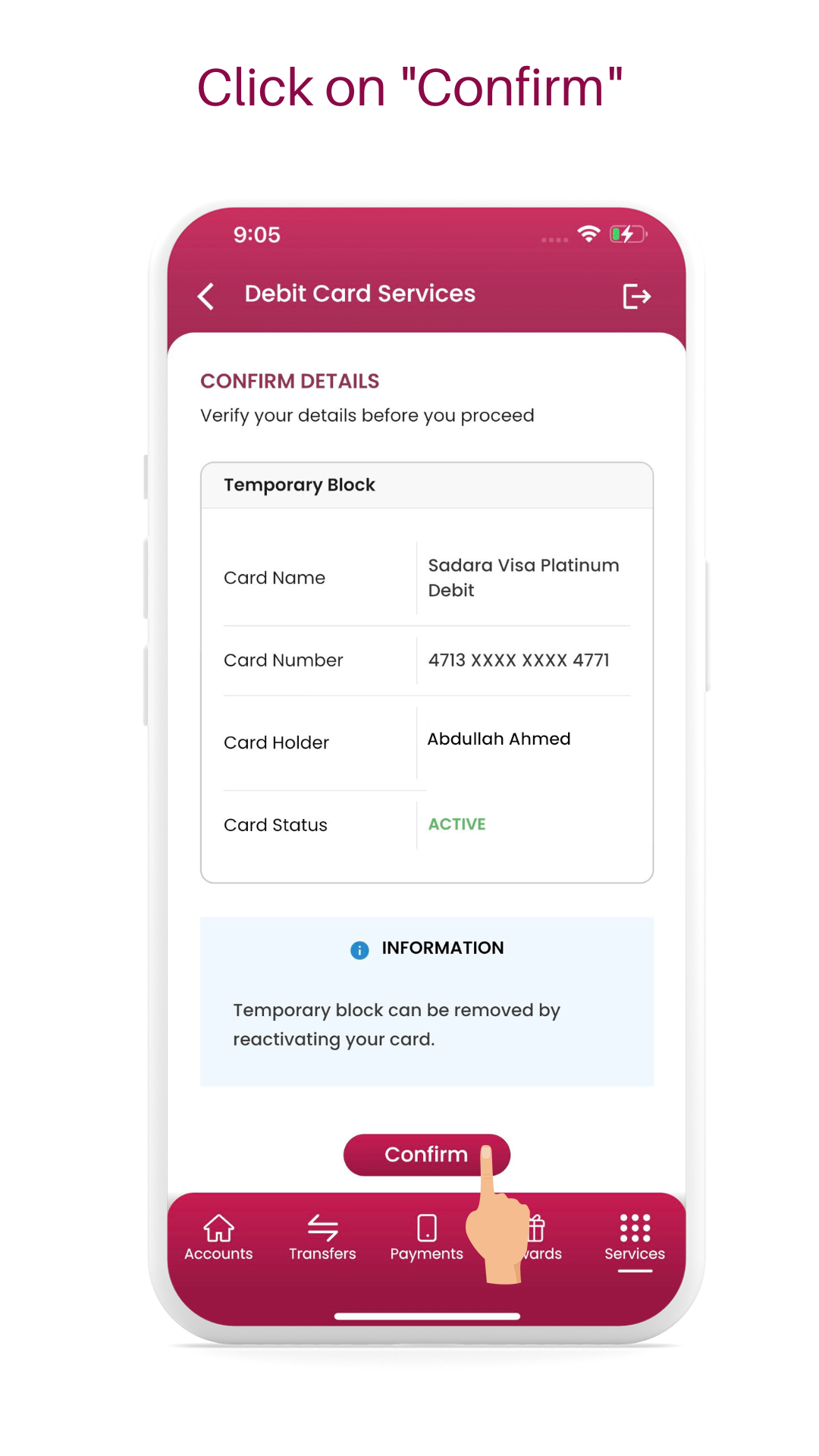

- Select the “Block Card” option and select the option “Permanent” to block your card permanently.

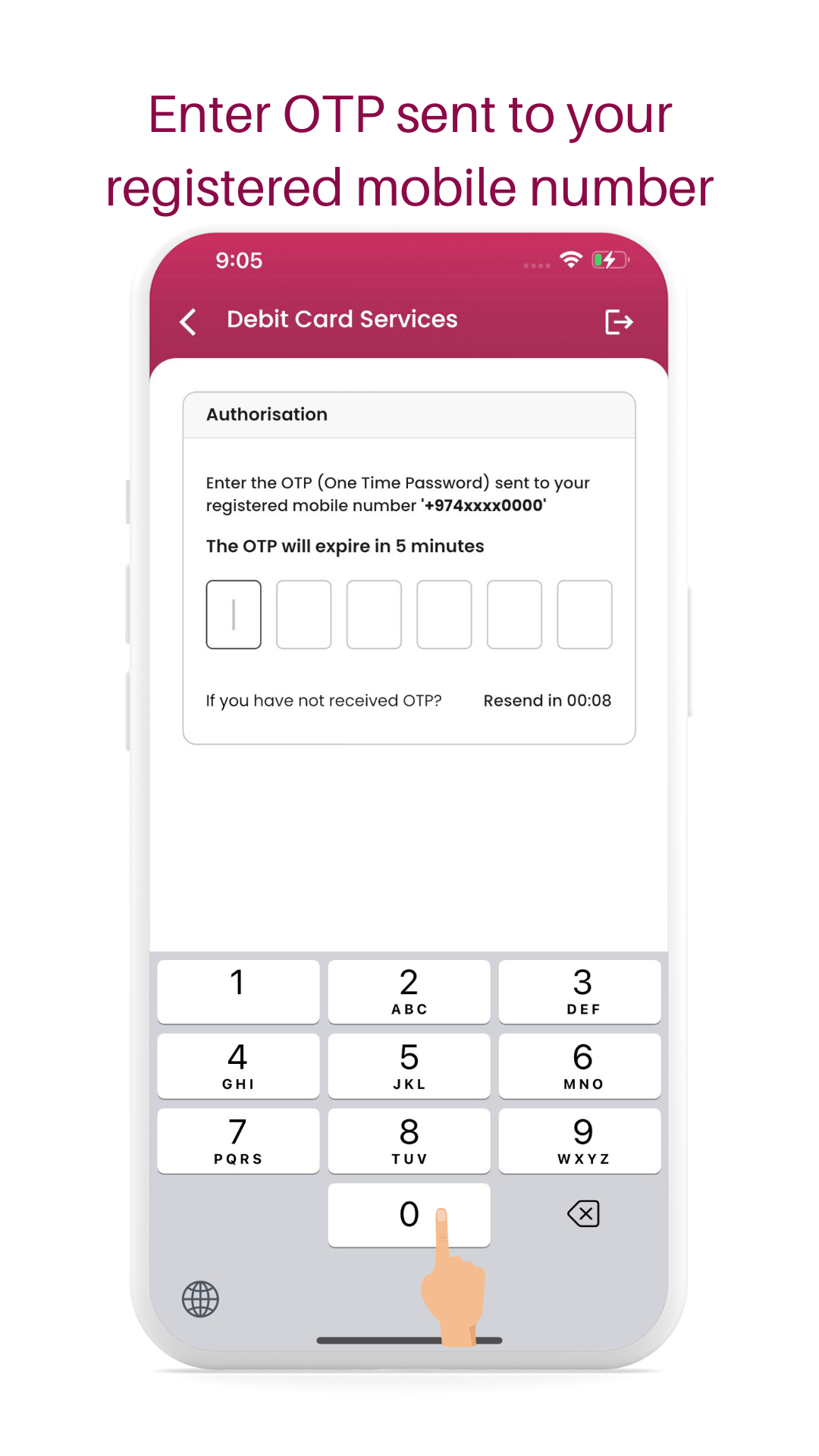

- Enter the OTP sent to your registered mobile number to block your card.

- Your card will be blocked successfully.

To replace the card, follow the below steps:

- Login to CBQ Mobile App or Internet Banking.

- Select the “Services” tab.

- Under menu, click on the “Debit Card Services” or “Credit Card Services”.

- Click on “Replace”

- Enter the OTP sent to your registered mobile number to replace your card.

- Your card will be replaced successfully. You will receive notification on how to print the card latest within next working day.

Contact Centre:

- Call our dedicated fraud reporting hotline number at 44495095

- Select your preferred language (English/Arabic)

- Listen to the IVR prompt and select "option 2" to block your card.

- IVR will allow you to temporary block a selected card or your entire cards instantly.

Call will be connected to an agent who can assist with replacing your cards.

If your Commercial Bank card is captured in any CB ATM, please follow the steps below to retrieve it:

- You will receive an SMS notification with details of the CB location where your captured card will be available for collection within 2–3 working days.

- Once you receive the notification, you may book an appointment to visit this CB location and collect your card (click to Book Appointment)

Alternatively, you may proceed to block the captured card and request for a replacement via our digital channels

Note: If your Commercial Bank card is captured in a non-CB ATM within Qatar or overseas, we recommend blocking your card immediately and requesting for a replacement.

Ways to activate your card

Additional Benefits, Features and FAQs

Contactless Payments

/cbpay.png?h=99&iar=0&w=100&hash=5E31B8B0AB6824CDCAC72E77AA85A9C1)

/applepay.png?h=99&iar=0&w=100&hash=A7CC4F23EC0EBAC8E4DD6A0555F878F8)

/gpay.png?h=99&iar=0&w=100&hash=43CA7686609401E901542773D704DAAE)

/fitbitpay.png?h=99&iar=0&w=120&hash=C4BE28B649D0413C0CA6E83F865FED5D)

/garminpay.png?h=99&iar=0&w=120&hash=A712BEC339763E6ABDC4DF714E87842A)

/checklist/authenticity.png?h=512&iar=0&w=512&hash=26F936525A7AE145085017B6C7576AFC)

/checklist/criteria.png?h=512&iar=0&w=512&hash=4FC5340A45E82ABD332F68B35AA122C1)

/checklist/discount.png?h=512&iar=0&w=512&hash=08482E2BBD77FA46F1EC81725F8A1435)

/checklist.png?h=54&iar=0&w=50&hash=9C4EF8220DB8DF1FB613B11A257E6D41)